ESIC Benefits For Employees, Full Form & Eligibility Details | Employee State Insurance Corporation Scheme for Family Members, Pregnancy Details – A social security and health insurance scheme has been started by the Employees State Insurance Corporation, named Employee State Insurance Corporation Scheme (ESIC). The Employees’ State Insurance Act, 1948 was enacted through the Parliament by the Government of India for the workers in independent India to strengthen social security. Under this, many workers were hired by manufacturing sectors to speed up manufacturing processes during the Industrial Revolution of the 1950s. (Also read- CBSE Training Portal Free Registration: Teachers Login, Certificate Download)

About ESIC Scheme 2024

Employees State Insurance Corporation has started a multidimensional social security program named Employee State Insurance Corporation Scheme (ESIC) to provide socio-economic security to all the citizens working in the organized sector and their dependents. Through this insurance scheme, financial assistance can be obtained by all eligible citizens in case of medical emergencies caused by industrial hazards, illness, or pregnancy. All the responsibility of operating the ESIC Scheme rests with the Employees’ State Insurance Corporation, which is a corporate entity. It also takes care that all businesses that manage the plan ensure that a new employee is enrolled in the program. (Also read- स्वदेश स्किल कार्ड: एप्लीकेशन फॉर्म, Swades Skill Card ऑनलाइन आवेदन)

प्रधानमंत्री नरेंद्र मोदी की योजनाएं

Overview of Employee State Insurance Corporation Scheme

| Scheme Name | ESIC Scheme |

| Launched By | Started by Employees State Insurance Corporation |

| Year | 2024 |

| Beneficiaries | All employees of the country |

| Application Procedure | Online |

| Objective | Alleviating financial stress brought on by health contingencies |

| Benefits | Financial stress brought on by health contingencies will be reduced |

| Category | Central Government Schemes |

| Official Website | https://esic.gov.in/ |

Objectives of ESIC Scheme

The main objective of the Employee State Insurance Corporation Scheme (ESIC) is to protect all employees from health related contingencies. Permanent or temporary disablement, illness or death due to occupational disease or injury, which impairs the ability of the employee to earn a living, will be covered under this scheme. Apart from this, through the ESIC Scheme, all the employees are financially supported in their sad circumstances. Along with this, maternity benefits are also provided to all the beneficiaries through this scheme, this will make them self-reliant and empowered. (Also read- One Nation One Mobility Car: NCMC Online Registration, Payment Process)

ESIC Scheme Act, 1948

The Employees’ State Insurance Act of 1948 was promulgated by the Parliament, it is often referred to as the ESI Act. This was the first important piece of social security legislation passed in the country after independence. Medical insurance and other necessary benefits to all workers and employees employed in factories, commercial establishments, newspapers, educational or medical institutions, organizations such as hotels, road transport, cinemas and shops, as provided by the ESI Act of 1948. are provided. The ESI system provides benefits to both workers and their dependents in the event of any adverse circumstances while working.

Employees’ State Insurance Scheme Contribution Rates

| Employee contribution rate | 0.75% of gross salary |

| Employer contribution rate | 3.25% of the total salary paid to the employees |

ESIC Scheme Contribution Period

| Tenure | Months |

| contribution period | 1 April – 30 September 1 October – 31 March |

| cash benefit period | 1 January-31 June 1 July-31 December |

Under What Conditions ESI Registration is Required

A business establishment, corporation, organization has to register for ESI if it provides employment to ten or more workers or twenty or more in Chandigarh and Maharashtra. Apart from this, the business has to be registered with ESIC, if an employee earns Rs 21,000 per month, or if a disabled person earns Rs 25,000, then all such citizens are eligible for coverage under ESI. Under this, the company contributes 4.7 percent to the ESI program and the employee contributes 1.75 percent of his salary. Sometimes these prices also fluctuate.

What is Covered by ESIS

- The program has recently been expanded to include restaurants, hotels, stores, cinema and preview theaters, newspapers, hotels and road-motor transport companies, etc.

- Apart from this, more than 3.49 crore Indian families and citizens will get its benefit by March.

- The Government has been informed that ESIS insurance under section 1(5) covers restaurants and retail establishments.

- It applies only to a limited number of states and union territories, it also covers private health care and educational organizations with ten or more employees.

What is Not Covered by ESIS

- Employees who earn Rs 21,000 or more in a month cannot join the Employees State Insurance Program.

- The coverage under the ESIS program is limited to a maximum of 10 employees in the rest of the State and Union Territories. Apart from this, permission to cover 20 employees is provided by states like Chandigarh and Maharashtra.

- Persons with disabilities who have a monthly income of Rs 25,000 or more will not be eligible for coverage under ESIC

Benefits of ESIC Scheme

- The medical cost of all the insured is covered under this scheme by affordable and reasonable healthcare facilities, and the employee is protected from the very beginning of their employment.

- Under this, 90% of the monthly salary is provided under the Employee State Insurance Corporation Scheme (ESIC) to all those insured who experience temporary disability till their recovery.

- Additionally, in case of permanent loss, 90% of the monthly salary can be used for the rest of the life.

- 100% of the daily wage is given to all the beneficiaries of this scheme for 26 weeks, which can be extended for an additional month on the basis of doctor’s recommendation.

- The benefit provided under this is up to twelve weeks in case of adoption and up to six weeks in case of abortion.

- Financial assistance is also provided in case the dependents of all the insured of ESIC Scheme are ill or fall victim to accidents at work.

- In this case all the dependents are eligible to receive the payment, this payment amount is divided equally among all the surviving dependents.

- The program provides up to 50% of average monthly wages in case of injury-related permanent disability or involuntary loss of employment for a maximum period of 24 months.

- Cash flow is provided under this scheme during Medical Leave of Absence, under which employees are eligible to receive up to 70% of daily wages for a total of 91 days, considered for two consecutive periods.

Features of ESIC Scheme

- All the employees of the country whose salary is 21,000 per month or equal to it, all of them will be covered under ESIC Scheme.

- Under this, the employer is currently required to contribute 3.25% of the payroll, and 0.75% should be contributed by the employees.

- The overall payment has been reduced by the central government from 6.5% to 4% in 2019, in addition to this, any worker whose daily wages are less than 137 is exempted from paying his share.

- Medical benefits can be availed by all the insured and their dependent family members for certain conditions.

- Under this, employers have to pay any overdue contribution within the first 21 days of the month.

- Under this scheme, it is mandatory for the state government to cover 1/8th of all medical costs up to 1500 per person.

- If any of the insured opts for early retirement, or is enrolled in the VHS scheme, then in this case they are provided with the benefit of this scheme.

- The establishment of more medical schools is also promoted through this scheme, so that the care of all beneficiary patients can be improved.

- The benefit of this scheme can also be availed by a person without a job for three years, but for this they have to include their dismissal letter and other relevant information about their previous employer.

- Additional allowances will be provided to women employees facing pregnancy related problems, in addition to this, they can extend their 26 weeks maternity leave up to a maximum of one month, without compromising on their pay slab.

- Accidents caused while traveling due to work related risks are also taken care of under the Employee State Insurance Corporation Scheme (ESIC).

ESIC Scheme Eligibility

- Applicants must be employed by a non-seasonal business with a minimum workforce size of 10 or more.

- In addition, the worker’s income is at least 21,000 per month.

- The applicant must be a native of India.

Required Documents

- Articles of Association and Memorandum of Association of the company

- PAN card details of the business unit and all employees.

- Compensation details of all employees.

- List of shareholders and directors of the company

- Canceled check of company bank account

- Register containing the details of attendance of employees. Employer’s Registration Form (Form No. 1) which should be downloaded online, filled and uploaded on ESIC website along with above documents

- Certificate of Registration in case of partnership or company

- Registration certificate obtained under Shops and Establishment Act or Factories Act

- List of all employees working in the establishment.

Cash Benefits of ESIC Scheme

| Benefits | Cash value |

| Disability benefits | As long as the person is temporarily disabled, he/she will be paid 90% of the previous salary. For permanent disability the person will be paid on pro-rata basis for the rest of his life |

| Dependent benefit | you get 90% of the salary |

| maternity benefits | For 12 weeks, you are fully compensated |

| funeral benefit | A benefit of up to Rs 10,000 is given for the last rites |

| RGSKY for Unemployment | In case of unemployment, you receive 50% of your salary for one year |

Progress on the Second Generation Reforms of ESIC

The health reform initiatives of various Employees State Insurance Scheme have been started in 2015 by the Prime Minister of the country, Mr. Narendra Modi. Following are the main agenda of these initiatives:-

- Online availability of electronic health records of ESI holders

- Regular Inspection of ESIC/ESIC Hospitals by Hon’ble Member of ESIC

- Specialties are being built (CT, ICU, MRI, Cat-Labs, Dialysis).

- medical helpline

- VIBGYOR – Operation Indradhanush

- Special OPD

- Quality control on drugs and medicines

- Pathological and X-ray in PPP model

- Behavioral training of doctors and para-medical staff, Yoga, AYUSH, Special Child and Mother Care Hospital, Queue Management, ‘May I Help You’ counters etc.

Procedure to Register under ESIC Scheme

All those employees who want to apply under Employee State Insurance Corporation Scheme (ESIC), they can register under it by following the following procedure:-

- First of all go to the official website of ESIC Scheme, after that the homepage of the website will open in front of you.

- On the homepage of the website, you have to click on the sign-up option, after that the next page will open in front of you.

- Here you have to enter the details of the information asked like- your name, mobile number, employer name, email id, region and state etc.

- Now you have to select the checkbox to confirm all the details of the company, after that you have to click on the submit option.

- After this you will receive your login credentials on your email id, after that you have to login to ESIC portal using your login credentials.

- After login, you have to click on the option of New User Registration, after that the next page will open in front of you.

- Now you have to enter the details of the information asked like- name of your unit, address of your factory and its nearest police station etc.

- Then you have to click on the option of Next, now you have to enter the nature and category of the business.

- Next, you have to enter the date of commencement of business, choose the constitution of the proprietorship and the proprietorship details.

- Now you have to enter the total number of employees working in your factory and the number of employees earning less than Rs 21,000 per month, and click on the save option.

- Then you have to select the date when the first ten employees were hired in the company, after that you have to click on the option of declaration.

- Now you have to enter IP name, date of birth, father’s name, gender, family details, marital status and date of joining etc., after that you have to click on submit option.

- After this, a new page will be displayed in front of you, now you have to select the ESI branch office and inspection division and click on the submit option.

- Then you have to click on the option of Pay Initial Contribution, you have to click on the option of Continue, now you have to make the payment, after that your registration process will be completed.

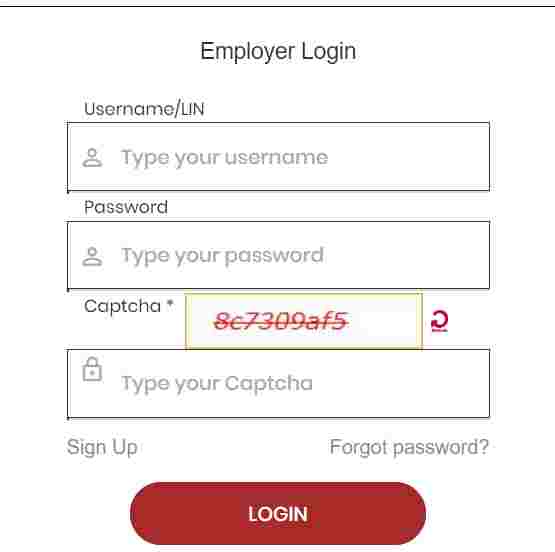

Steps to Login under ESIC Scheme

- First of all go to the official website of ESIC Scheme, after that the homepage of the website will open in front of you.

- On the homepage of the website, you have to click on the option of employer login, after that the login form will open in front of you on the next page.

- On this page you have to enter the details of the information asked like- username, password, captcha code etc.

- Now you have to click on the option of login, by following this process you can login under this scheme.

Contact Details

- ESI Head Office:-

- Employee’s State Insurance Corporation

- Panchdeep Bhavan

- Comrade Indrajeet Gupta (CIG) Marg,

- New Delhi – 110 002

- Phone numbers:-

- 011-23234092

- 23235496

- 23234093

- 23234098

- 23236998

- 23236051

- 23235187.

- Medical Helpline:- 1800-11-3839

- Toll-Free/Help Desk Number:- 1800-11-2526

- Email address:-

- For IT related issues: itcare@esic.nic.in

- For complaints/suggestions: pg-hqrs@esic.nic.in