Apply for PAN Card Online & Track Status Online, Fee & Documents | Download PAN Card, Get Permanent Account Number – In view of the increasing digitization the Government of India is releasing many facilities and schemes online, so that citizens do not face any kind of problem and they can take advantage of all government facilities sitting at home. As we know that a PAN Card is a very important document which is required by almost all citizens. The central government has made its application and download process online. Now any citizen who wants to apply for his PAN Card can apply online from home. [Also read- Covishield Certificate Download at cowin.gov.in (COVID-19 Certificate)]

What is a PAN Card ?

PAN Card is a “Permanent Account Number”, which is a 10 digit code consisting of letters and numbers. This code signifies the identity of the citizen and the required information of the citizen such as name, date of birth, father, spouse’s name and photograph is printed on it. It acts as a kind of proof of ID card and date of birth. Along with this, this card is issued by the Income Tax Department to every applicant so that with the help of this, people can be prevented from paying tax. With the help of this code, the citizen can be tracked what he does with his money. A citizen can have only one PAN number as it is a unique code. [Also read- Digital Health ID Card Apply Online: Download & Check Age Limit][Read More]

Keep in mind: the deadline for linking Pan Cards with Aadhaar Cards is March 31.

Overview of Permanent Account Number (PAN)

| Article Name | PAN Card |

| Launched By | Government of india |

| Year | In 2024 |

| Beneficiaries | All Peoples of Country |

| Application Procedure | Online/Offline |

| Objective | Portal to Apply Online |

| Benefits | Get Pan Card Online |

| Category | Central Government Schemes |

| Official Website | https://www.onlineservices.nsdl.com/paam/endUserRegisterContact.html |

Type of Pan Card

- Pan (For Government Agency)

- An Artificial Judicial Person

- Pan Card For Indian Individuals

- Pan Card For Indian Companies

- One Pan For People Living Abroad

- Pan For Foreign Companies

- Association Of Persons

- A Limited Liability Partnership

- Body Of Persons (Boi)

- Pan For Partnership Firm

- Pan For Trust

- Pan For Hindu Undivided Family (Huf)

- Pan For The Local Authority.

Required Eligibility

The list of organizations eligible for Permanent Account Number has been issued under Section 139A of the Income Tax Act which is as follows:-

- Any person who pays tax or is liable to pay tax to the Income Tax Department can apply for a PAN card.

- A company owner who has more than 5 lakh in annual sales can get his PAN card.

- Head of every Hindu Undivided Family (HUF), any corporation, LLP, AOP/BOI, etc. is eligible to apply for a PAN card.

- Organizations like charity, trust, or organization can also apply for a PAN card by making their application.

- In future any prospective taxpayer who is still a minor will have to apply for a PAN card.

- All foreign partners in an Indian subsidiary foreign investment venture who have an existing basis can apply.

In Short: All the people who pay tax including Corporations, Students, Children, Hindu Undivided Families, Limited Liability Partnerships, Associations of Persons, Trusts, Artificial Judicial Persons, Local Authorities, Partnership Firms, Residents in India, for PAN Card You can make your application.

Benefits and Features of PAN Card

- Having a PAN card makes it easy to buy or sell vehicles other than two wheelers.

- A PAN card is required for opening an account with a banking company other than a fixed deposit in which a deposit of Rs 50,000 and above is required during a financial year.

- If a citizen has to make his application for the continuation of his credit card, then for this it is necessary to have a PAN card.

- A PAN card is required while making payments for travel to foreign destinations or for purchase of foreign currency on a single event.

- PAN card is also used while making bank drafts or pay orders or banker’s checks from a bank or any type of co-operative bank.

- If you have to pay an amount of more than Rs 50,000 in someone’s account, at that time also it is necessary to have a PAN card.

- Any mutual fund company is required to have a PAN card document to buy its units and also to buy its debentures or bonds issued by the institution.

- A PAN card is also required for making cash payments or bank draft payments for an aggregate amount exceeding Rs 50,000 in a financial year for one or more prepaid payment instruments.

- It is also necessary to have a PAN card for paying insurance premiums for an aggregate amount exceeding Rs 50,000 in any financial year.

- If the company is not listed on any recognized stock exchange then a PAN card is required for buying and selling of shares of the company.

- A person below the age of eighteen years can use the PAN of his father, mother or guardian provided he does not have any income payable as income tax.

Required Documents

- Documents As Personal Evidence

- Applicant’s Aadhar Card

- Voter Id Card

- Passport

- Driving License

- Ration Card With Applicant’s Photo

- Photo Identity Card Issued By Central/State Government

- Pensioner Card With Applicant’s Photo

- Original Identity Certificate Signed By Member Of Parliament / Member Of Legislative Assembly / Municipal Councilor / Gazetted Officer

- Address Proof Document of The Applicant

- Indian Bank Account Statement.

- Postpaid Cell Phone Bill (Like In Jio, Airtel, Vodafone, Bsnl, Etc.)

- Bill For Electricity And Broadband Internet Service.

- Credit Card Statement (Banks That Are From India Only).

- Gas Connection Bill

- Passport

- Passbook For Post Office

- Deposit Account Statement

- Driving License,

- Voter Id Card.

- Date of Birth Proof (Any One Of The Following Is Sufficient)

- Passport 10th Certificate

- Driving License

- Domicile Certificate

- Date Of Birth Certificate Issued By City Authority

- Marriage Certificate Issued By The Registrar Of Marriages

- Documents Required For Companies

- Certificate Of Registration Issued By Registrar Of Companies

- Documents For Persons Who Are Not Indian Citizens

- Proof Of Identity

- Proof Of Address

Procedure to Get Pan Card Offline

To get the PAN card offline, you have to follow the simple procedure mentioned below, which is as follows:-

- First you have to visit the official PAN center. After this you have to fill the application form to get the PAN card form.

- After filling the application form, you have to attach a photo and some documents like your ID, address proof etc.

- Now you have to submit this application form along with the fee for processing to the PAN center. Your Permanent Account Number will be mailed to you at your address.

Procedure to Get PAN Card Online through NSDL Portal

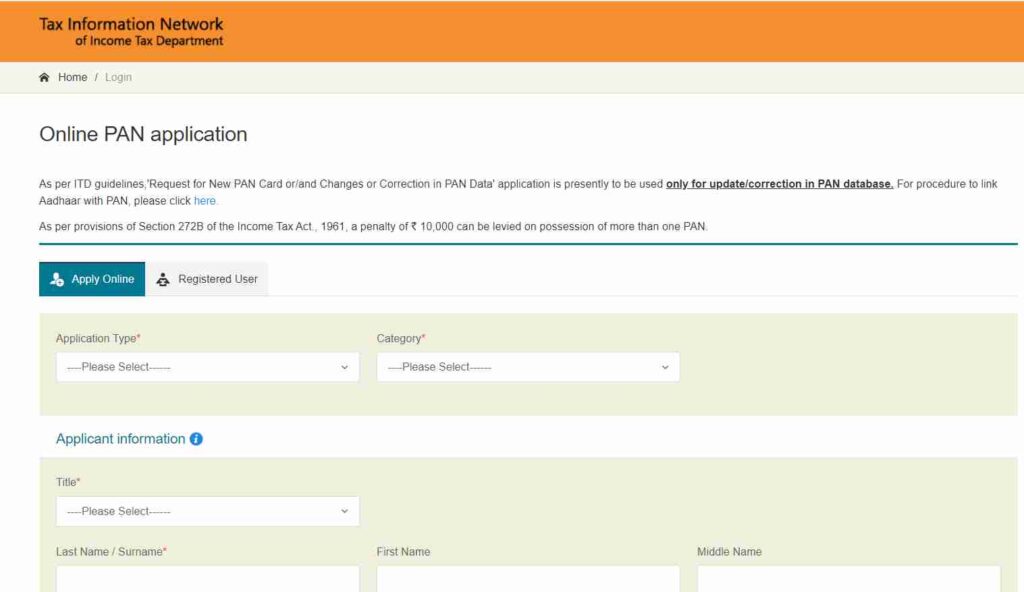

PAN card is an essential document, to get it online, you have to follow the simple procedure given below, which is as follows: –

- First of all you have to visit the official website of NSDL. After this the homepage of the website will open in front of you.

- On the homepage of the website, you have to select the type of your application i.e. New PAN for Indian Nationals, Foreign Nationals or Change/Correction in existing PAN data.

- Now you have to choose your category among individuals, association of persons, body of persons, etc. After this you have to fill in all the required details like name, date of birth, email address and your mobile number in the PAN form.

- On submission of the form you will get a message about the next step and you have to click on the button “Continue with PAN Application Form”.

- A new page will open in front of you where you have to submit your digital e-KYC. Now you will be asked whether a genuine PAN card is required or not and after that provide the last four digits of your Aadhaar number.

- Now you have to enter personal details, contact, area code, AO type and other details. The last part of the form is document submission and declaration.

- You have to enter the first 8 digits of your PAN card to submit your application form. You will get to see your filled form. If no modification is required then click on proceed.

- Select the e-KYC option to verify using Aadhaar OTP. For Proof of Identity, Address and Date of Birth, select Aadhaar in all fields and click on Proceed to continue.

- Now you will be redirected to make payment where you have to pay either through Demand Draft or through Net Banking/ Debit/ Credit Card.

- On successful payment a payment receipt will be generated and you click on continue.

Procedure to Get Acknowledgment Slip by Verifying Aadhar Card

- For this, now you have to tick the declaration for Aadhaar authentication and select the option “Authentication”. Now you have to click on “Continue with e-KYC”.

- After which an OTP will be sent to the mobile number linked to Aadhaar. You have to enter the OTP and submit the form.

- Now click on “Continue with e-Sign” after which you have to enter your 12 digit Aadhaar number. An OTP will be sent to the mobile number linked to Aadhaar.

- You enter the OTP and your date of birth as password in DDMMYYYY format and submit the application to get the acknowledgment slip in PDF.