New PF Withdrawal Rules 2024 for Higher Education, Home Loan & Medical | Check EPF Withdrawal Process, Limit & Timings – Employees’ Provident Fund is an essential retirement savings program, often referred to as Provident Fund. All the employees of an eligible organization are covered under this program, the employees of the country can count on their post-retirement corpus with the help of this scheme. Recently the rules of PF Withdrawal have been updated, with the help of these rules, all the customers of the country get easy access to PF funds. In today’s article, we are going to provide you with all the important information related to PF Withdrawal Rules. [यह भी पढ़ें- (PMJAY) आयुष्मान भारत योजना: Ayushman Bharat Yojana ऑनलाइन आवेदन]

PF Withdrawal Rules

One contribution-based savings program is PF Withdrawal, where financial contributions are provided by both the company and the employee to create a fund to cover post-retirement expenses. The corpus created by the employee is accessed or withdrawn, subject to withdrawal regulations by certain provident funds, moreover, the Employees’ Provident Fund is managed by the Employees’ Provident Fund Organisation, a statutory organization in India. Through this, economic security is provided to Indian citizens working in the organized sector.[Read More]

Overview of PF Withdrawal

| Article Name | PF Withdrawal |

| Launched By | Employees’ Provident Fund Organization |

| Year | 2024 |

| Beneficiaries | employees of the country |

| Application Procedure | Online |

| Objective | Providing customers with easy access to their PF funds |

| Benefits | Customers will be provided with easy access to their PF funds |

| Category | Central Government Schemes |

| Official Website | https://www.epfindia.gov.in/ |

PF Withdrawal Rules Check

- Unlike a bank account when a person is employed, EPF account does not allow withdrawal, EPF is a type of long term retirement savings scheme, under which money can be withdrawn by any interested person only after retirement.

- PF Withdrawal is permitted in case of emergency, such as medical emergency, acquisition or construction of a house, or further education, etc. Further, partial withdrawals are subject to restrictions depending on the reason, partial withdrawal can be made electronically by the intending account holder. Withdrawals can be requested.

- 90% of the EPF corpus can be withdrawn by an employee up to one year before retirement, for which he should be at least 54 years of age.

- By the way, early retirement has not been allowed till any person is 55 years old, EPF funds can be received by the citizens only after retirement.

- Additionally, if a person is laid off before retirement due to lockdown or retrenchment, then the EPF corpus can be stopped.

- Under the new rule, PF Withdrawal of 75% of the EPF fund is allowed after EPFO is unemployed for one month, under this the remaining 25% can be deposited in the new EPF account after getting new employment.

- Citizens desirous of withdrawing money must first declare themselves unemployed, apart from this, earlier 100% of EPF money could be withdrawn after two months of unemployment.

- Under this, if the EPF amount is prematurely withdrawn by a person, then in this case tax is deducted at source, under this TDS is not necessary, even after this if the total amount is less than Rs.50,000. , in case a person submits his PAN along with the application, TDS rate of 10% will be applicable under this. On the contrary, if the PAN card is not submitted by the employee, then in this case the cost is 30% plus VAT.

- One declaration form is Form 15H/15G, through which it is claimed that TDS can be avoided as the entire income of a person is not taxable.

- Under this, the employees no longer need to wait for the employment authority before withdrawing EPF, under this, if the employee’s UAN and Aadhaar are linked and the employer has given its approval, then in this case, through EPFO immediately. can be done. Apart from this, the status of their PF Withdrawal can be checked online by all the employees.

- Tax exemption is available on withdrawing EPF corpus under certain restrictions, when an employee contributes to EPF account for 5 consecutive years, then only in this situation tax exemption on EPF corpus is available to the employees.

- If the contribution to the account is stopped for five years, then in this case the EPF amount becomes taxable, so the entire EPF amount for that financial year will be considered as taxable income.

PF Withdrawal Terms

Many conditions have been set under PF Withdrawal Rules, some of its conditions are as follows: –

- Employees to continue in service when:-

- For an employee who wants to get an advance amount from a PF account, then it is mandatory to submit a Composite Claim Form in this situation. Apart from this, if customers want to use their PF account to pay for their LIC coverage, then all those customers have to fill Form 14 as well.

- Employees above the age of 58 years have to submit Form 10D to the Pension Fund, along with this, when the employees complete ten years of service, after that they will be eligible to get a monthly pension. On the contrary, if you have not earned ten years of qualifying service by an employee, then in this case the employee has to submit a complete claim form.

- Change of job by employee:-

- If the job is changed by an employee, then in this case the EPF account of that employee is definitely transferred, for this the employees have to submit Form 13 application. Even after this claim can be filed by an employee with PF and Pension Fund. If the employee leaves the company and is not transferred by him to another location, only the Composite Claim Form, either with or without Aadhaar, can be used by the employee to claim the same.

- Employees who have earned ten years of service eligibility and are above 58 years of age can claim pension by using Form 10D. Apart from this, the Composite Claim Form can also be used by the employees to submit the pension claim.

- When employees leave the company due to physical disability:-

- The claim for monthly pension by the employees can be submitted with Form 10D.

- Employees are eligible to submit PF claims using Composite Claim Form (Aadhaar/Non-Aadhaar).

- Employees whose age is more than 58 years and their qualifying service is less than ten years, then the claim for pension and PF benefits can be filed by all those employees. To do this, they have to use the Composite Claim Form.

- When an employee dies while in service:-

- When an employee passes away before the age of 58 years, an application for PF settlement can be made by the beneficiary, nominee or successor using Form 20. All those employees will have to submit Form 10D every month to receive pension payments, along with this they will have to submit Form 5IF for Employees Deposit Linked Insurance (EDLI)

- Under this, if the employee dies after 58 years and after completing ten years of qualifying service, then in this situation the claim can also be filed by the nominee of the employee. Nominees have to use Form 5IF for EDLI withdrawal and Form 20 for PF withdrawal. Apart from this, if the citizens want to claim their monthly pension, then in this case Form 10D should be filled by them.

- When employees leave after retirement:-

- Form 20 can be used by the heir, nominee or beneficiary of the deceased employee to submit the PF claim. Apart from this, they have to use Form 10D to claim the monthly pension.

- All the beneficiaries are eligible to receive pension funds under it, even if the employee has not earned ten years of qualifying service after the age of 58 years. All those citizens will have to do so by submitting the Aadhaar/Non-Aadhaar Composite Claim Form.

PF Withdrawal Limit

| Reasons | Eligibility | Withdrawal Limit |

| Marriage of self /daughter/son/ sister/ brother or for children’s post-matriculation education | Minimum 84 months of service | Up to 50% of the EPF account |

| Housing loan for building a house or adding on, buying a lot, or renting a flat | Minimum 60 months of service | Up to 36 months of his or her base pay plus DA, the sum of the employee and employer portions plus interest, or the full cost of the home |

| Medical expenses/ purchase of equipment by physically handicapped /Natural Calamity/closure of factory/cut in electricity in the establishment | No minimum service tenure | His/her basic and DA pay for up to six months, or the full contribution |

| One year before retirement | should be older than 54 years old | Up to 90% of his/her EPF amount |

Online PF Withdrawal Procedure

All those employees who want to do PF Withdrawal online, they can complete the PF withdrawal process by following the following procedure:-

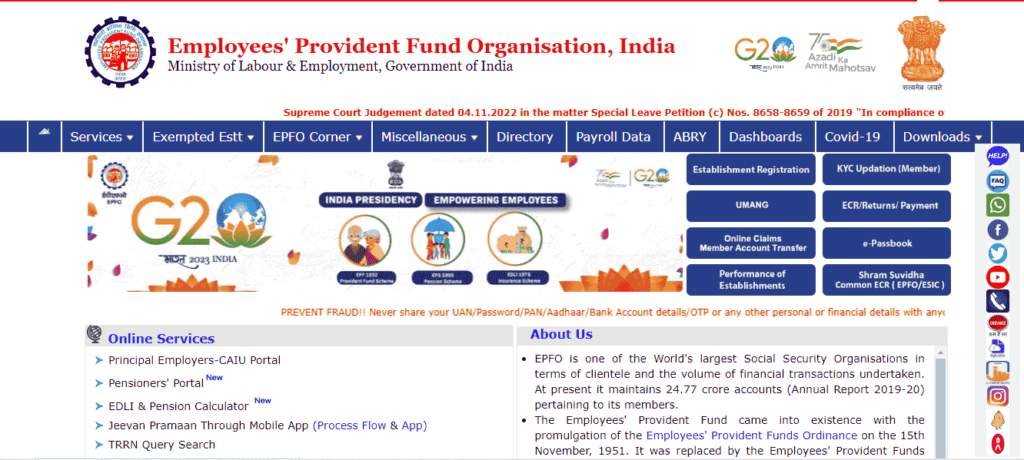

- First of all, you have to go to the official website of the Employees Provident Fund Organization (EPFO) portal, after that the homepage of the website will open in front of you.

- On the homepage of the website, you have to click on the option for employees from the service section, after that a new page will appear in front of you.

- Now you have to click on the option of Member UAN/Online Service (OCS/OTCP) from the section of Services, after that a new page will be displayed on your screen.

- Here you have to enter the details of the information asked like- UAN, password and captcha code etc., after that you have to click on the option of login.

- After this, the account dashboard will open in front of you, now under the Manage tab, click on the KYC option.

- Then the next page will open in front of you, now, under the digitally approved KYC section, check all your KYC details.

- Now to proceed with the withdrawal you have to select the Online Services link from the top menu, if all KYC details are correct then you have to click on the option of Claim Form-31, 19 & 10C.

- Online Claim (Form 31, 19 & 10C) form will be displayed on the screen, just enter the last four digits of your registered bank account number.

- A Certificate of Undertaking will be generated once the bank account is successfully verified, finally, the option to “Proceed for Online Claim” has to be clicked.

- PF Advance (Form-31) option is to be selected to withdraw money online, choose the justification for the claim from the drop-down menu next to the option “Reason for which the advance is required”. Fields for the employee’s address and the amount of the advance must also be filled out. Now, click on the checkbox and submit your withdrawal application.

- After this you have to upload the required documents depending on the type of withdrawal, if the employer agrees to the withdrawal request, the withdrawal money will be deducted from the EPF account and paid into the respective bank account. Once the claim is settled, you will receive an SMS notification on your registered cellphone number.