E Swathu Karnataka Property Registration Charges & App Download @ e-swathu.kar.nic.in | E Swathu Form 9,11 Download Kaveri Reports – The E Swathu portal has been launched by the Government of Karnataka to reduce forgeries and scams related to land and properties. Under this portal, citizens get property facts and related documents to reduce forgery, scams related to land and properties. Along with this, the land ownership record of rural areas will be improved through online medium. Along with this, the registration of unauthorized layouts through E Swathu Karnataka is also kept under control. [Also Read – Karnataka LMS Scheme: Learning Management System, Benefits & Registration Form]

E Swathu Karnataka 2023

A program called E Swathu has been organized by the Government of Karnataka, through this information is obtained about who has what etc. in rural areas. The responsibility of proper operation of this portal in the state has been given to the Rural Development and Panchayati Raj Department. The registration of plots and properties in illegal layouts is regulated through this program and helps in reducing fraud in land and property related transactions. In addition to keeping the most up-to-date records of ownership and physical information of properties falling under the jurisdiction of each Gram Panchayat (GP) as well as being used to update information in case of transfer of ownership, gift, through E Swathu Karnataka is done. [Also Read – Karnataka Saptapadi Vivah Yojana 2023 | Mass Marriage Scheme]

Overview of E Swathu Karnataka

| Scheme Name | E Swathu |

| Launched By | By Government of Karnataka |

| Year | 2023 |

| Beneficiaries | Citizens of Karnataka State |

| Application Procedure | Online |

| Objective | Reducing fraud and forgery involving real estate and properties |

| Benefits | Fraud and forgery relating to immovable property and properties will be curtailed |

| Category | Karnataka Government Schemes |

| Official Website | https://e-swathu.kar.nic.in |

Objectives of E Swathu Portal

The main objective of E Swathu Karnataka is to reduce fraud and forgery related to real estate and properties in the state of Karnataka. Through this, ownership and physical asset data is maintained for each gram panchayat. In addition to this the information is updated under E Swathu Portal in case of exchange of property by inheritance or gift, government land acquisition, court proceedings, limitations, liabilities etc. Using this portal a property owner can communicate the facts of the property to avoid forgery and keep records. [Also Read – (Form) Karnataka Free Laptop Scheme 2023: Apply Online, Registration, Eligibility]

E Swathu Form 9

E-Swathu Form 9 is also known as A-Khata Document, this paper is made by the Gram Panchayat. Issue of Form-9 for non-agricultural properties exclusively to the property under their jurisdiction subject to fulfillment of the following conditions.

- It should be legally converted into non-agricultural property as per the Karnataka Land Revenue Act, 1964 by the concerned Revenue Department office.

- Apart from this, it is mandatory for the schemes to have approval under the concerned government department.

- The property should be verified by the Tehsildar as well as its status should be confirmed within the Gramathana of the village.

- The property is required to be released to the beneficiaries of Ambedkar, Basava Vasathi and Indira Awas Yojana government housing schemes.

E-Swathu: What is Form 11

It is also the responsibility of the individual GP to complete Form-11 for any non-agriculture property falling under his jurisdiction.

- This letter is issued as per the Karnataka Panchayat Raj (Gram Panchayat Budgeting and Accounts Rules) Rules 2006.

- This record is also known as demand register of collection and balance of land and building, under this demand register is another name of this register.

The process of property tax collection is facilitated through Form-9 and Form-11.

Features of E Swathu Karnataka

- In rural areas of Karnataka it is clarified who is the owner of the property through E Swathu Portal in a legal way.

- It keeps up-to-date records like who has what, etc. as the system is completely digital.

- Apart from this, the physical details of such properties are also monitored through this portal, which comes under the control of the Gram Panchayat.

- The Gram Panchayat Department can provide details about property information to other government offices if needed.

- Along with this, if the data is required by the government agencies, then in this situation information can be easily obtained from the Gram Panchayat Department. And details of ownership etc. can also be obtained.

- All kinds of information about citizen ownership change, gift, inheritance, government projects can also be obtained by the citizens through this portal.

- E Swathu Karnataka is supported by the state language, which is Kannada and English language.

- Digital signature on all the forms can also be done by the Panchayat Development Officer under this, a kind of unique number is provided in these, this number can be used by the citizens to check the document, this makes the authentication solid.

Documents for Form 9

- The Karnataka Panchayat Raj is in charge of putting out this document (Rule 28, Amendment Rules 2013) as stated by the Rules, 2006.

- Make sure that your form is scrutinized by the Tehsildar and a sketch is shown of where it is located at the Gram Thana of the village.

- Under the Town and Country Planning Act, the government department in charge of planning must sign off on the form.

- The form is usually provided to citizens who live in government housing schemes like Basava Vasati, Ambedkar and Indira Awas Yojana.

- Applicant, ID Proof like Voter ID, Aadhaar Card, Address Proof and also a Photo.

Documents for Form 11

- Form 11 is not used for agriculture.

- The Karnataka Panchayat Raj Rules of 2006 should be used to decide who has the right to govern.

- Under this, the register of balance of demand, collection, building and land is used to generate Form 11, which is extracted from that record.

Use of Form 9 and 11

- Importantly, Form 9 and Form 11 are often used in the process of collecting property tax, the owner of the property is compelled by the existence of the papers to pay the tax.

- Along with this, it is also necessary for the registration of non-agricultural properties through these papers that it is necessary to complete all kinds of processes.

- Both of these are necessary land documents, which are shown by the citizens while selling immovable property within the jurisdiction of the Gram Panchayat.

Procedure to Generate Form 9 and Form 11 under E Swathu

All the citizens of Karnataka state who want to make Form 9 and Form 11 under E Swathu Karnataka can get these forms made by following the following procedure:-

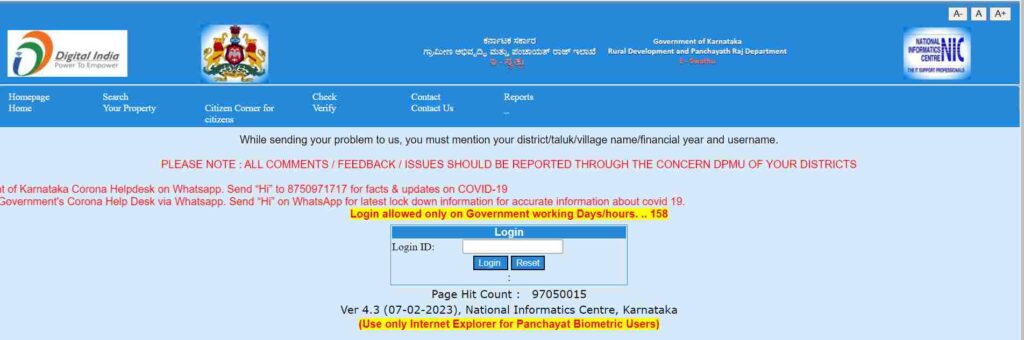

- First of all you have to go to the official website of E Swathu Karnataka, after that the homepage of the website will open in front of you.

- On the homepage of the website, you have to enter the login ID in the section of login and click on the option of login, after that the next page will open in front of you.

- To log in to the web portal, you have to use fingerprint biometric input, followed by biometric verification at each stage of the login process.

- Now you have to click on the option of Select the second available option to enter the information of the new property.

- After that you have to enter all the available data in the fields provided, then click on “Ulisu Bone” at the bottom of the page.

- After the file is saved you have to go back to the previous step and click on the option of ‘Owner’ In this section, you will be provided with the task of performing the following actions within the multiple tabs accessible on the screen.

- Enter the information about the owner(s).

- Please provide any documents that can verify your ownership.

- Now you have to enter the property details such as property dimensions, GP coordinates, rights, liabilities, required documents, and survey number, along with any other information that is required.

- After entering all the information, you have to click on the save option, by following this process you can create the form.

For Form 11

- For Form 11 first you have to submit your registration details and electricity details, under this form 9 and 11 are automatically generated for you when you save the entries.

- When you have finished saving your submission, you have to select the application number that appears.

- Now you have to click on the option of ‘Processive Approval’ to forward the application to the subsequent stage of official approval.

- In this, you have to choose a house or business, make necessary comments and then you have to click on the button next.

- Under this, Gram Panchayat Secretary through the use of his login will be able to see the forms which are waiting for verification with him and which have been sent to the Gram Panchayat Secretary.

- Those who are responsible for them, after verifying the validity of the application, it will either be forwarded to the Panchayat Development Officer or it will be sent back for further editing.

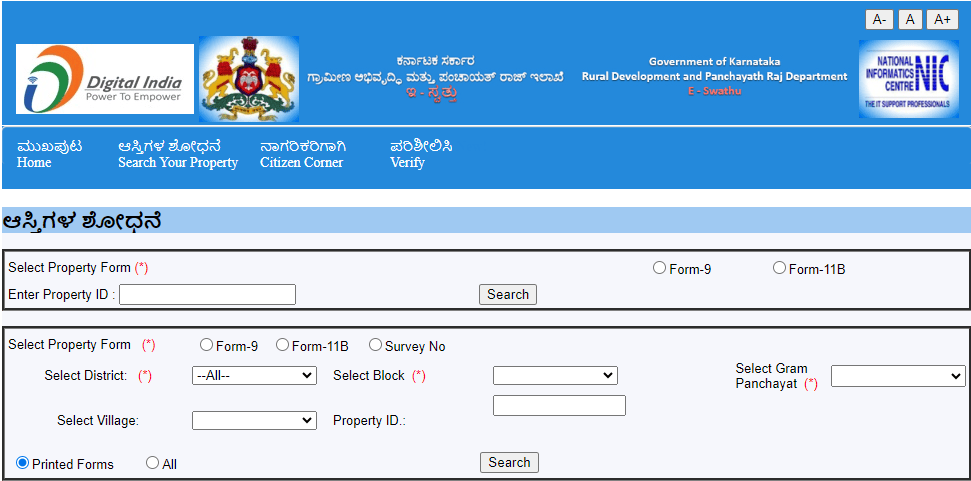

Find Form 9 and Form 11

- First of all you have to go to the official website of E Swathu Karnataka, after that the homepage of the website will open in front of you.

- On the homepage of the website, you have to click on the option of Search Your Property, after that the next page will open in front of you.

- On this page you have to enter the details of all the information asked like- document number, property code, property owner name, village name and property number ID etc.

- Now you have to enter the document number to get the form, by following this process you can get both Form-9 and Form-11.

- If you want to see other information, then you have to click on the option of all, thus you will be able to see the property details.

Procedure to Check Kaveri Report Property Status

- First of all you have to go to the official website of E Swathu Karnataka, after that the homepage of the website will open in front of you.

- On the homepage of the website, you have to click on the option of Kaveri Reports from the section of Reports, after that the next page will open in front of you.

- Here you have to choose between Property ID, Registration Number, Village-wise, Date-wise, or Summary report.

- After this you have to enter the details of the information asked, after that you have to click on the request ID.

- By following this procedure you can conveniently check the status of Kaveri Report Assets.

Procedure to Calculate Tax on E Swathu Karnataka

- First of all you have to go to the official website of E Swathu Karnataka, after that the homepage of the website will open in front of you.

- On the homepage of the website, you have to click on the property tax calculation option from the check verify section, after that the next page will open in front of you.

- Here you have to enter the details of the information asked such as property ID and tax year etc.

- Now you have to click on the submit option, after that the property tax due amount will be calculated.

Types of Changes or Mutations

Title to a piece of property can be passed from one person to another in a number of ways, such as through inheritance or sale, through mutation of property which is a change in official registration ownership, confirmed by It is verified that the property tax is being paid by the genuine citizen. Only after this you can register with the SRO or with the Gram Panchayat, in addition to this there are two types of changes in the property:-

- Registered Changes– When a property stamp is registered at the Registration Office, in this case all the details are entered on e-Swathu.

- Changes that are not registered– Such properties which are not registered in the SRO, then in the local Gram Panchayat office these properties are amended in the local Gram Panchayat office.

The different types of unregistered mutations are:-

- sale deed

- Deed of gift to change the type of roof of building etc.

- property number change

- change in asset type