EPFO Higher Pension Online Application Direct Link, Calculator & Login | EPFO Higher Pension Apply Link, Latest Circular & Guidelines – On Monday, the deadline for opting for higher pension was extended till May 3 by the Employees’ Provident Fund Organization (EPFO). Under the EPFO Higher Pension Scheme, such employees of the country who had started their work before September 1, 2014 and continued their work, yet they were unable to activate their joint option, now from May 3. can do it first. In today’s article, we are going to provide you with all the important information related to EPFO Higher Pension, like for what purpose this scheme has been started, and what are its benefits and eligibility, etc. [Also Read- Delhi Marriage Registration: Apply Online, Application Status, Fee Details]

EPFO Higher Pension 2024

The provident fund, or EPF, is a monthly deduction of 12% of the employee’s basic salary received by the employee, compounded annually, and also paid in a lump sum to you on retirement. In addition to this, sometimes 8.33 percent of your employer’s contribution to EPFO Higher Pension or EPS, the individual’s contribution of 12 percent goes entirely to the individual’s EPF account, in a separate program for guaranteed pension payments after retirement. Several changes were introduced by the central government on September 1, 2014. Under the EPFO Higher Pension Scheme, 15,000 is used to calculate the 8.33% EPS contribution. The salary cap till then was around Rs 6,500. [Also Read- [Book] Delhi Oxygen Cylinder Home Delivery Scheme: Apply Online]

Overview of EPFO Higher Pension Scheme

| Scheme Name | EPFO Higher Pension |

| Launched By | BY Employees’ Provident Fund Organization |

| Year | 2024 |

| Beneficiaries | Employees of the country |

| Application Procedure | Online |

| Objective | To facilitate the employees to apply for higher pension after retirement |

| Benefits | Facility will be provided for employees to apply for higher pension after retirement |

| Category | Central Government Schemes |

| Official Website | https://unifiedportal-mem.epfindia.gov.in/memberinterface/ |

Objectives of EPFO Higher Pension 2024

The main objective of EPFO Higher Pension Scheme 2024 is to facilitate the employees of the country to apply for higher pension. The last date to apply for higher pension has been extended by the Employees’ Provident Fund Organisation, now all the employees can apply to get higher pension conveniently. [Also Read- Delhi Mutation Certificate (Dakhil Kharij): How to Download Online]

Benefits & Features of EPFO Higher Pension Scheme

- If an employee’s pension is high, then in this case the employee is provided with a higher monthly check during retirement.

- Apart from this, if an employee does not have any other means of income, then EPFO Higher Pension 2024 can be very helpful for those employees.

- Under this, the amount of pension of the employee is fixed, in addition to this, the amount received by the employee after retirement is unaffected by the market. Because it is based on years of service and average salary.

Eligibility for EPFO Higher Pension Scheme

- All citizens who have applied for registration and activation of their accounts under the Employees’ Provident Fund Organization are eligible to receive higher pension.

- The applicant person has been working as a government employee with the Employees Pension Scheme for more than 10 years.

- The benefits of this scheme can be availed only by the employees between the age of 50 to 58 years.

- One who has worked for the Government before and after 1st September, 2014.

EPFO Higher Pension Scheme Contribution under EPS

After the 2014 amendment, a lot of problems were arising regarding pension contribution on higher wages. Under this, it has been accepted by many workers that the shared option to contribute to the pension was exercised at a higher income level. Joint option submitted by many employees was rejected by EPFO. Employers have contributed 8.33% of pension without filing joint options on the actual salary of employees. Under this pensionable salary was used in pension calculation of about Rs 15,000, cases have been filed in high courts by various employees on the basis of contribution made on actual salary amount to get more pension. The matter was presented before the Supreme Court, the summary of the judgment of the Supreme Court is as follows:-

| Employee Status | Exercise of Joint Option | Eligibility for 8.33% of a Higher Salary’s Pension Contribution | Higher Pension Claim Mode |

| Employees in service as of 01- September-2014 | Exercised joint option and rejected by the EPFO | Yes | By filing a higher pension claim application |

| Employees retired before 01- September-2014 | Exercised joint option and rejected by the EPFO | Yes | By filing a joint option and higher pension claim application |

| Employees in service as of 01- September-2014 | Not exercised joint option but contributing to EPS above the cap of Rs.5,000/Rs,6,500 | Yes | By exercising the joint option within 03/05/2023 |

| Employees retired before 01- September-2014 | Not exercised a joint option | No | Not applicable |

EPFO Higher Pension Scheme 2024 Application Last Date

Citizens have time till September 30, to apply for higher pension under the EPFO Higher Pension Scheme. With effect from 1st September, 2014, the Employees’ Provident Fund Organization (EPFO) members can now elect their pension on the basis of their actual basic pay. These instructions have been introduced to allow old members to draw larger pensions through EPFO and make larger contributions to 8.33 percent EPS against the monthly limit of Rs 15,000 in pensionable salary.

To Consider Before Opting for Higher Pension

Following are some considerations for choosing a higher pension:-

- Taxable Vs Tax-Exempt– Under this, it is important to keep in mind that the lump sum amount from the provident fund is tax-exempt. Under this, the pension amount will be taxable, if an employee has additional sources of income available, and you fall in the higher tax bracket, then in this case the amount of the employee’s pension will be reduced due to taxes.

- Cost– Pays more for opting for higher pension in EPS, in addition employer’s contribution is capped at 8.33% of Rs 15,000 per month, employees can opt to contribute up to 8.33% of salary Is. If your monthly salary is more than 15,000 to get more pension than that person has to provide additional voluntary contribution to EPS.

- Instead of a lump sum – any person should be informed before doing any other work that the higher pension will be provided at the cost of the lump sum payment, therefore it should be elected by the employee when the higher pension is paid by the employee The choice of pension is made as compared to a higher lump sum payment after retirement.

- Long term planning– You should keep your long term retirement plans in mind while considering choosing a bigger pension. Under this, you have an alternative retirement income option available, so in this situation the employee will not need a large EPS pension. On the contrary, if a person does not have any other source of retirement income, then in this situation higher EPS pension can be beneficial. Your unique financial situation and retirement objectives will influence whether you choose a larger EPS pension. One needs to carefully weigh the costs and rewards when making a choice. Talking to a financial advisor is beneficial to make an informed choice.

- In case of death– Further, if the EPF subscriber passes away due to any reason, then only his legal heirs and nominees will be eligible to receive 50% of the qualifying pension. Additionally, if the subscriber dies earlier than expected, the family will suffer a significant financial loss in this situation as compared to the higher lump sum option.

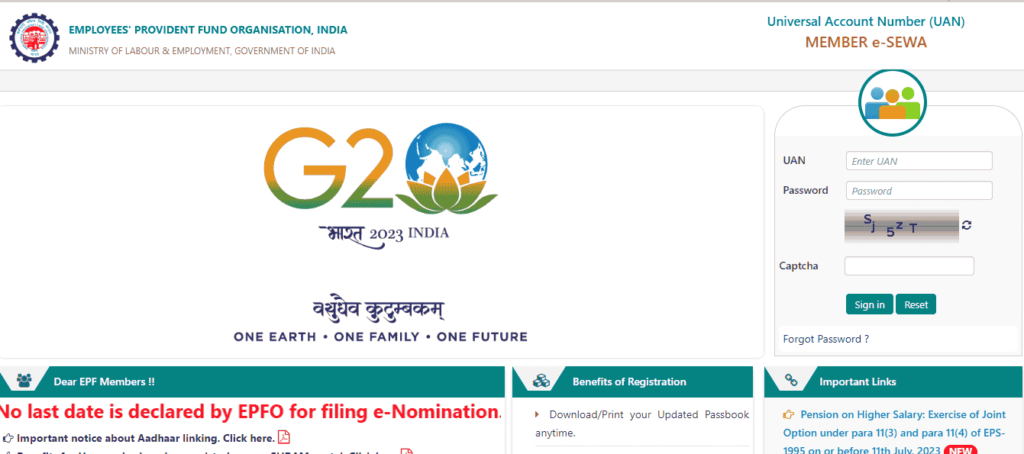

Procedure to Apply for EPFO Higher Pension Scheme

All those citizens who want to apply under EPFO Higher Pension Scheme can apply under this scheme by following the following procedure:-

- First of all, you have to go to the official website of EPFO Unified Member Portal, after that the website homepage will open in front of you.

- On the homepage of the website, you have to click on the option of Pension on Higher Salary: Exercise of Joint Option under para 11(3) and para 11(4) of EPS-1995 on or before the 3rd May.

- After this you have to click on the option of application form for combined options, after that the next page will open in front of you.

- Here two options will be displayed in front of you, 1, If you have left your job before that year, then select “Verification of joint options who retired before 01.09.2014 and exercised joint option”. and 2, if you have retired after that year “Exercise the joint option for those employees who were in service before 01.09.2014 and continued to be in service as on 01.09.2014 but unable to exercise the joint option” Select where”.

- You have to choose one of these two options, after that the application form will open in front of you.

- In the application form, you have to enter the details of all the information asked, after that you have to click on the submit option.

- Now every application will be digitally registered by EPFO and the applicant will get an acknowledgment number.

- It will send the applications to suitable employers who will verify them through e-signature or digital signature before continuing with the application process. Thereafter all applications will be converted into e-files by RPFC.

- After reviewing the documents, the case will be forwarded by the responsible Dealing Assistant to the Section Accounts Officer or Supervisor.

- Thereafter discrepancies will be noted by the concerned Accounts Officer or Supervisor after verification and forwarded to Assistant Provident Fund Commissioners (APFCs)/RPFC-II.

- After reviewing the applications, the APFC/RPFC-II Higher Pension decision will be communicated to the applicants by email, mail, phone or SMS.

Formula for Calculating EPF Higher Pension

The formula to calculate EPF higher pension is as follows:-

Monthly Pension Amount = (Pensionable Salary * Pensionable Service)/70

- Pensionable salary is called the average of the salary of the last 60 months.

- The number of years paid is called pensionable service in the EPS account.

If an employee retires at the age of about 58 years after rendering pensionable service of more than 20 years, then in this case a weightage of 2 years will be applied to the period of service. However, there is a limit of 35 years for pensionable service.