MSME SAMADHAAN Portal Registration & Login @ samadhaan.msme.gov.in | MSME Delayed Payment Portal Complaint Submission, Case Status, Eligibility Details- The Ministry of Micro, Small and Medium Enterprises in India has recognized the sector as the engine driving the country’s economy. By this, equitable development is encouraged for all citizens, MSME SAMADHAAN has been launched in the country by the Ministry of Micro, Small and Medium Enterprises (MSME). Through this portal, micro and small business owners are supported across the country, thereby benefiting them immensely.[यह भी पढ़ें- (Vivah Panjikaran) विवाह पंजीकरण: शादी प्रमाण पत्र ऑनलाइन आवेदन, स्टेटस चेक]

MSME Delayed Payment Portal 2024

A program called MSME SAMADHAAN has been launched by the Ministry of MSME. Online complaints can be lodged with the appropriate MSEFC about the buyer of goods or services in his State or Union Territory through this portal. The status will be examined by the MSEFC Council in case of complaint perforation, as well as proactive action by it to proceed with the penalty of interest to the rules and regulations provided by the concerned departments, CPSEs, Central Ministries, State Governments and others. Additionally, cases related to delayed payments by Central Ministries, Departments, CPSEs and State Governments can also be reported through the MSME Delayed Payment Portal. [यह भी पढ़ें- एलआईसी आम आदमी बीमा योजना | ऑनलाइन आवेदन, क्लेम फॉर्म पीडीएफ]

Overview of MSME Delayed Payment Portal

| Portal Name | MSME SAMADHAAN |

| Launched By | By the Ministry of Micro, Small and Medium Enterprises (MSME) |

| Year | 2024 |

| Beneficiaries | Citizens of the country |

| Application Procedure | Online |

| Objective | Monitoring of Delayed Payments to MSME Sector |

| Benefits | Delayed payments to MSME sector to be monitored |

| Category | Central Government Schemes |

| Official Website | https://samadhaan.msme.gov.in/ |

Objectives of MSME Delayed Payment Portal

The main objective of MSME SAMADHAAN is to monitor delayed payments to all sectors of MSMEs, all State Governments and their Public Sector Undertakings as well as Central Government and Central Public Sector Enterprises regarding Ministries and Departments through this portal. Under this, the ability to register their delayed payment issues is provided. Apart from this, online complaints can also be registered under MSME Delayed Payment Portal, if the complaint is found, then in this situation the MSEFC Council status will be investigated. [Also Read- e-RUPI | PM Modi Digital Payment Solution, (QR code SMS e-Voucher), Benefits]

The Provisions that will be Established by the State Government

A type of provision has been issued in the Micro, Small and Medium Enterprises Development Act of 2006 to address payment delays to micro and small businesses. This provision is found in Chapter 15 to 24 of this Act, Micro and Small Enterprise Facilitation Council should be formed by each state government. This will address the challenges of registering delayed payments and obtaining references in the country. In addition to this, clear reference to this information is also given by Chapter 20 and Chapter 21 of the MSMED Act. [Also Read- SC OBC Free Coaching Scheme: Registration at coaching.dosje.gov.in]

Features of MSME Delayed Payment Portal

- Business owners and MSEs are allowed to submit online requests for delayed payments through MSME SAMADHAAN.

- It is mandatory for the user to have an Udyog Aadhaar number which is verified for applying using the physical Aadhaar card.

- MSMEs and business owners can check the status of their online applications for delayed payments through this platform.

- Details of payments which are still pending between MSEs and specialized CPSEs, Central Ministries, State Governments etc. All those payment details will be included under this portal.

- Apart from this, the data is open to the entire public under the MSME Delayed Payment Portal.

- He will be in charge of monitoring the cases of delayed payments coming under his purview and issuing necessary instructions by the CEO and Secretary of the concerned Ministry to remove the problems related to it.

Delayed Payment to MSMEs

The date agreed upon between the buyer and the micro or small firm, the buyer has to make the payment on or before that date. Apart from this, if any goods or services are supplied by the buyer, then in this case he will have MSME registration. Payment shall be made by the buyer within fifteen days from the date of acceptance of the products or services, unless the payment due date is specified in the agreement. In any case, the payment due to a micro or small business cannot take more than 45 days from the day it was accepted. [Also Read- electoralsearch.in | ECI Search Name in Voter List, Electoral Roll PDF]

Penalty for Late Payment to MSME Businesses

Under this, if the buyer fails to make the payment in time, in which case the supplier shall pay the amount, with monthly interest, with compound interest, starting from the date of payment to the buyer fifteen days after the acceptance of the goods, services Does matter. Additionally, the penal interest payable to MSME business for late payment is three times the bank rate, as announced by the Reserve Bank of India, as the Income Tax Act allows deduction by the buyer for the penal interest paid or payable by the buyer. If not provided, it becomes too much of a burden. [Also Read- (Apply) KDA New Plot Scheme: Application Form, Online Registration]

Disclosure Requirement in Annual Statement

- In the event of a buyer requesting to see the annual accounts, it shall be the responsibility of the buyer to record the following information in the annual statements.

- Any micro or small supplier still owes principal and interest at the end of the accounting year.

- Plus the total amount of interest that should be paid for late payment under this.

- The value of any late payments made by Buyer plus interest payments to Buyer.

Documents Required for Filing Late Payment Complaint

- PDF files of Respondent’s work orders and invoices submitted in response to those orders.

- An affidavit stating that the purchase order was given orally should be supplied.

- Under this the size of the document should not exceed 1 MB.

Procedure for Submission of Application on MSME Delayed Payment Portal

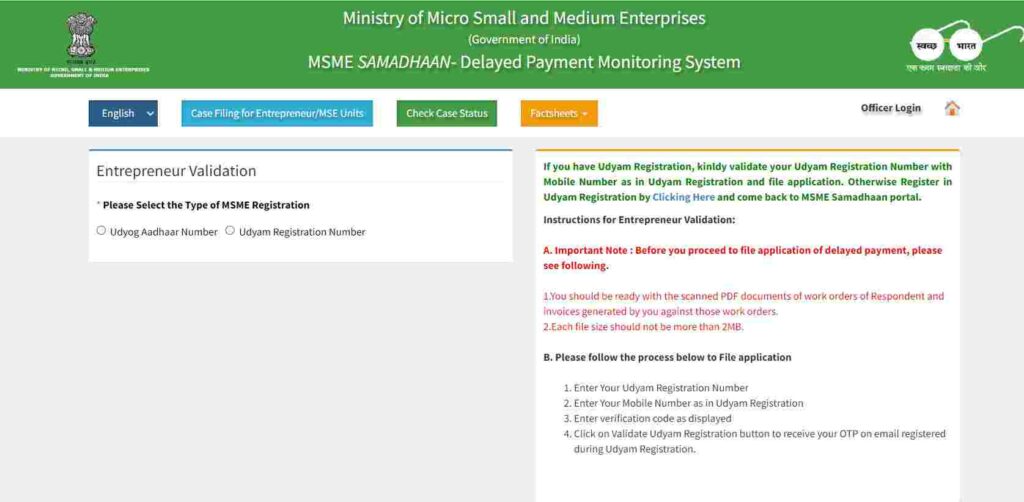

All those citizens who want to apply under MSME SAMADHAAN, they have to apply under it by following the following procedure:-

- First of all you have to visit the official website of MSME Samadhan, after that the homepage of the website will open in front of you.

- On the homepage of the website, you have to click on the option of Case Filing for Entrepreneur/MSE Units, after that the next page will open in front of you.

- Here you have to choose any one of Udyog Aadhaar Number, Udyam Registration Number. After this you have to enter the details of all the information asked like- Udyog Aadhaar / Udyam Registration Number, and your mobile number, captcha code etc.

- After this you have to click on the option of Validate. After this an OTP will come on your registered mobile number or email ID.

- You have to enter the OTP, after successful verification, you have to upload all the required documents.

- Now you have to click on the submit option, by following this process you can apply under it.

Procedure to Check the Status of MSME Samadhan Case

- First of all you have to visit the official website of MSME Samadhan, after that the homepage of the website will open in front of you.

- On the homepage of the website, you have to click on the option of check case status, after that the next page will open in front of you.

- Here you have to choose any one option out of Udyog Aadhaar Number and Udyam Registration Number.

- After this you have to enter the details of the information asked like- Udyog Aadhaar / Udyam Registration Number, or Application Number / Case Number, Captcha Code etc.

- Now you have to click on the option of login, by following this process you can check the status of the solution case under MSME Delayed Payment Portal.