Stand Up India Loan Scheme Application Form | Stand Up India Loan Scheme Online Registration | Track Stand Up India Loan Scheme Application Status

The Government of India keeps implementing many schemes to take its country towards development, which directly benefits the residents here. One such scheme has been started by the government to promote women power, which has been named the Stand Up India Loan Scheme. Hon’ble Prime Minister of India Shri Narendra Modi has launched this commendable scheme to promote entrepreneurship among women in Scheduled Castes and Scheduled Tribes areas. [Also Read- PMJAY CSC: Registration, Login, Download Ayushman Card | Mera PMJAY]

Stand Up India Loan Scheme 2024

The Prime Minister of the country, Shri Narendra Modi, has started this Stand Up India Loan Scheme 2024 on 15 August 2015 to promote entrepreneurship among women belonging to Scheduled Castes and Scheduled Tribes and to make them financially empowered. Under this scheme, about 2.5 lakh beneficiaries will be benefited through 1.25 lakh banks, and this loan amount can be from Rs 10 lakh to Rs 1 crore. can avail of credit facility for the purpose, and the enterprise may be a manufacturing, service, agricultural allied activity or trading sector. [Also Read- NVSP Voter ID Status: Search Voter ID Card, E Epic Card Download at nvsp.in][Read More]

Overview of Stand Up India Loan Scheme

| Scheme Name | Stand Up India Loan Scheme |

| Launched By | By Indian Government |

| Year | In 2024 |

| Beneficiaries | Citizens of India |

| Application Procedure | Online |

| Objective | To Provide Financial Assistance for Setting up an Enterprise |

| Benefits | 10 lakh to 1 Crore Loan Benefit |

| Category | Central Government Schemes |

| Official Website | www.standupmitra.in |

Objective of Stand Up India Loan Scheme

To reduce the unemployment rate in the country and to promote entrepreneurship, Hon’ble Prime Minister has launched this Stand Up India Loan Scheme, through which the development of the country is their main objective. So far, more than 1 lakh women promoters have benefited from the operation of this scheme and till March 24, a loan of Rs 30,160.45 crore has been sanctioned in 133995 accounts. Due to the implementation of this scheme, it is part of the government’s objective to increase entrepreneurship by providing financial assistance ranging from Rs 10 lakh to Rs 1 crore to SC, ST or women entrepreneurs living in the country.[Read More]

Benefit and Features Of Stand Up India Loan Scheme

- No subsidy of any kind is given to the applicant under the Stand-up India scheme.

- The loan repayment period is up to a maximum of 7 years, and the maximum moratorium period has been kept up to 18 months.

- The loan through the scheme will be provided only for setting up new enterprises in the trade, services and manufacturing sectors.

- All SC, ST and women entrepreneurs of the country can apply under the loan facility.

- If the applicant wants to avail benefits under this scheme, he/she should not be in default with any bank or NBFC.

- The minimum age criterion for availing loan through stand-up scheme has been kept at 18 years.

- To take his country on the path of development, the Prime Minister of the country has started this Stand Up India Loan Scheme.

- Aid from the bank, the benefit in the loan amount can be between Rs 10 lakh to 1 crore.

- Overall loan of 85% of the project cost including term loan and working capital will be provided to the applicant

- This loan will be given for a manufacturing, service, agricultural allied activity or business sector only.

- An online process will be developed for submission and subsequent tracking of complaints through the portal.

- The borrower will be required to invest at least 10% of the project cost as his own contribution.

Eligibility Criteria of Stand Up India Loan Scheme

- To take advantage of this scheme, the applicant must be a permanent resident of India.

- The applicant who wants to get the benefit of the scheme should be a Scheduled Caste, Scheduled Tribe or a woman entrepreneur.

- Applicants who are above 18 years of age are eligible to apply.

- The applicant should not be a defaulter of any bank or financial institution under the scheme.

- In case of non-individual enterprise, 51% shareholding and controlling stake should be held by SC, ST or women entrepreneurs.

- Under Stand Up India Loan Scheme, loans will be provided only for greenfield projects.

Required Documents

- Aadhar card of the applicant

- Caste certificate

- Application loan form

- Permanent residence certificate

- Age certificate

- Passport size photograph

- Mobile number

- E mail ID

Application Procedure under Stand Up India Loan Scheme

Interested applicants can apply for this scheme by following the given steps if they fulfill the eligibility criteria given above-

- First of all, you have to visit the official website of Stand Up India Loan Scheme. After this, the homepage of the website will open in front of you.

- On the homepage of the website, you will have to click on the option “Click here for handholding support or apply for loan“. After this, a new webpage will be displayed in front of you.

- Now on this new page you have to choose your category, and enter your name, email id, and mobile number. After that click on the button of “Generate OTP”.

- Enter the “OTP” received on the mobile phone in the OTP box, and click on the “Register” option.

- After that you have to click on the option of “Login”, and login through the login credentials generated on the mobile.

- On the web page displayed after login, you have to click on the “Stand Up India Loan Scheme” option. After that the application form will be displayed in front of you.

- Now enter all the details asked in this application form carefully, and upload the mentioned documents together.

- After uploading the documents, submit this application form by clicking on the “Submit” button. Thus your application will be completed.

Details Required While Providing Loan

Following are the details required while granting the loan:-

- Borrower’s location

- Class

- Nature of Business

- Availability of space to conduct business

- Assistance needed for preparation of project plan

- Skills and training required

- Bank account details

- Own investment in the project

- Need help raising margin money

- Any previous experience in business

Types of Borrowers under Stand Up India Loan Scheme

Ready Borrower– A borrower who does not require any kind of assistance is called a ready borrower. He can apply for the loan in his selected bank, and he will get the application number. Thereafter all the information of the borrower will be shared with the respective link office of Bank LDM, NABARD and SIDBI. Then the loan application will be generated and tracked through the portal

Trainee Borrower – The borrower who requires assistance will be called as Trainee Borrower. Support for this type of borrower will be in the form of financial training, skilling, margin money mentoring, support utility, connections etc. Along with this, LDM will also monitor the process of work with SIDBI and NABARD local offices. The loan application will be generated through the portal after adequately meeting the hand holding requirements and obtaining the satisfaction of the LDM and the trainee borrower.

Responsibilities of Stakeholders under Stand Up India Loan Scheme

Borrowers

- The borrowers under this scheme are required to make payments within the stipulated time period.

- If the borrowers are apprentice borrowers, they will have to go through a sequence of hand holding support.

- The borrowers have to answer certain questions if they want to access the portal, or visit the bank branch.

- All necessary documents have to be submitted.

- Must share experience.

- Participate in all quarterly events on best practices etc.

- Efficiently setup and run the enterprise

Bank Branches

- Monitoring the performance under the scheme properly.

- If anyone has a complaint, the complaint should be redressed at the bank level within 15 days.

- Properly assist potential borrowers in accessing the portal

- Processing all applications received online or in person.

- Providing loan within stipulated time frame

- If the loan is rejected due to any reason, the reason for the rejection should be provided.

- The borrower should get the whole situation known correctly

DLCC

- Redressal of all complaints at the district level.

- Public utility service for potential borrowers

- Resolving work related issues

- Review progress periodically

LDM

- Monitoring the progress of the scheme.

- Participation in events organized by NABARD with all stakeholders

- To organize timely meeting of district level committee

- Satisfy the requirement of hand holding to the borrowers to the maximum extent

- Complying with all relevant authorities

- Providing information to bankers of potential borrowers

Nabard

- Organizing events as and when required (at least once in every quarter) among stakeholders for experience sharing

- Assist SLB and DLCC in review and monitoring

- Coordinate with LDM

- Liaise with the bank for possible follow-up action

- Arrange Handholding Support

- Provide training to other stakeholders

SIDBI

- To participate in the programs organized by NABARD

- Coordinate with LDM

- Liaise with the bank to follow up on possible cases

- Arrange Handholding Support

- Operation and Maintenance of Web Portal

- To assist SLBC and DLCC in review and monitoring

Stand Up India Loan Scheme Statistics

| TOTAL APPLICATIONS | 139408 |

| Total amount | 33098.87 crore |

| Approved Application | 121046 |

| Sanctioned amount | 27295.18 crore |

| hand holding agencies | 24724 |

| HHA Request | 10603 |

| Lender onboard | 367 |

| Connected Branches | 152576 |

List of Banks Providing Loans Under Stand Up India

| Axis Bank | Indian Bank |

| Bank Of Baroda Indian | Union Bank Of India |

| Kashmir Bank Limited | State Bank Of India |

| Bank Of India Jammu | Canara Bank |

| IDBI Bank | Bank Of Maharashtra |

| UCO Bank | Punjab And Sind Bank |

| ICICI Bank | PNB Bank |

| Central Bank Of India | Overseas Bank |

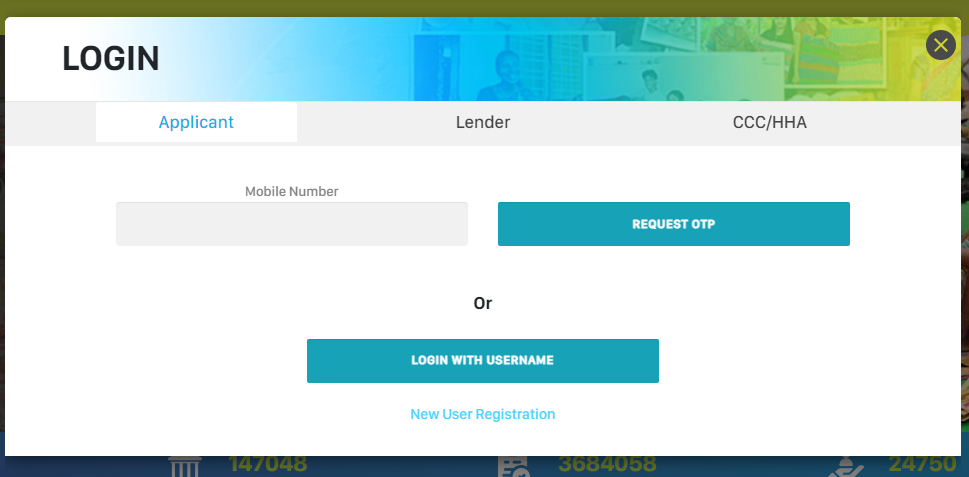

Procedure to Login to the Portal

- First of all you have to visit the official website of “Stand Up India Loan Scheme”. After this the homepage of the website will open in front of you.

- On the homepage of the website, you have to click on the “Login” option. After this the following options will appear in front of you:-

- Applicant

- Other users

- Out of these, you have to click on the option as per your requirement, and enter your username and password.

- After entering the information, you have to click on the login button, and by following this process you can log in to the portal

Track Application Status

- First of all you have to visit the official website of “Stand Up India Loan Scheme”. After this the homepage of the website will open in front of you.

- On the homepage of the website, you have to click on the “Application Status” option. After that a new page will be displayed in front of you.

- Now on this page you have to enter your login credentials and click on the login button. After that you have to click on the link of “application status” from the webpage.

- After clicking, you have to enter your “Reference Number”, and click on “Track” button, then application status will be displayed on your computer screen.

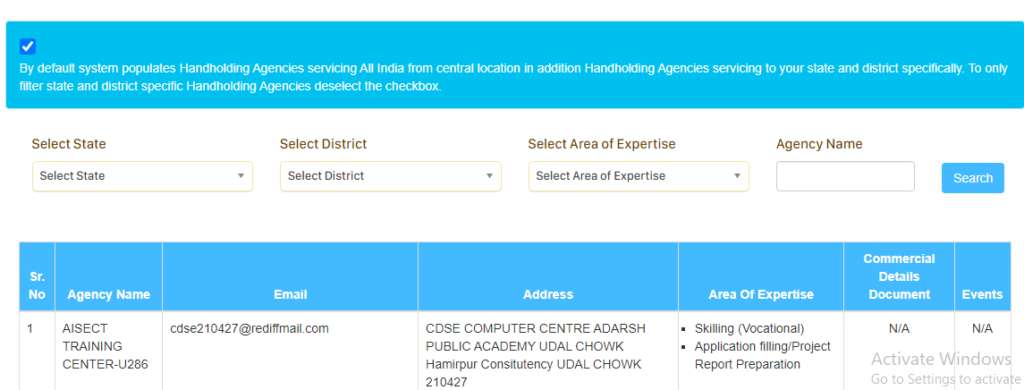

View Details of Health Centers Across India

- First of all you have to visit the official website of “Stand Up India Loan Scheme”. After this the homepage of the website will open in front of you.

- On the homepage of the website, you have to click on the option “Health Centres”. After that a new page will be displayed in front of you.

- Now on this page, you have to select the desired state, district, specialization and agency name, and click on the “search” button.

- After clicking, the required information will be displayed in front.

Process to View Details about LDM

- First of all you have to visit the official website of “Stand Up India Loan Scheme”. After this the homepage of the website will open in front of you.

- On the homepage of the website, you have to click on the option “LDM”. After that a new page will be displayed in front of you.

- Now on this page, you have to select the desired state, district, specialization and agency name, and click on the “search” button.

- After clicking, the required information will be displayed in front.

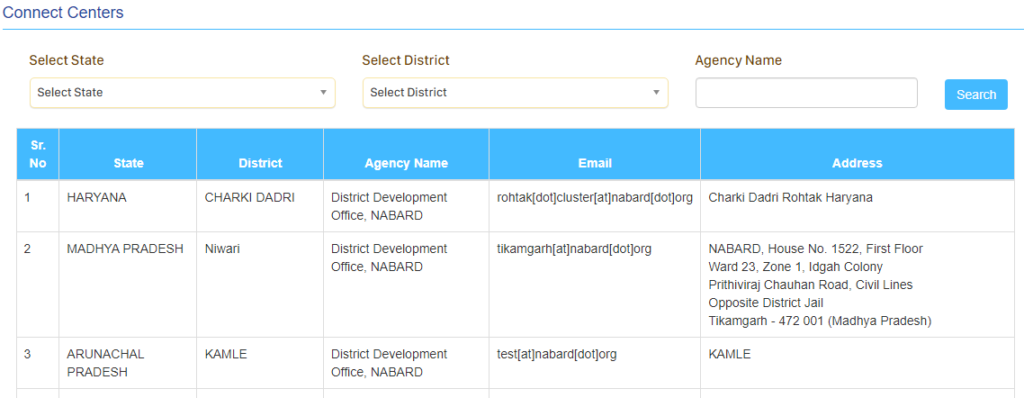

View Details About Connect Centers

- First of all you have to visit the official website of “Stand Up India Loan Scheme”. After this the homepage of the website will open in front of you.

- On the homepage of the website, you have to click on the “Connect Centres” option. After that a new page will be displayed in front of you.

- Now on this page, you have to select the desired state, district, specialization and agency name, and click on the “search” button.

- After clicking, the required information will be displayed in front.

Contact Information

Email – support@standupmitra.in , help@standupmitra.in

National Helpline Toll Free Number-1800-180-1111

FAQ

How can I apply for Stand-up India?

To apply under the Stand-up India scheme, first of all visit the nearest bank branch. Then apply for the loan, and fill and submit the loan application form along with the required documents and photographs.

Is there any subsidy in Stand-up India?

No, no subsidy is given under this scheme.

What is the difference between Startup India and Stand-up India?

Startup India is an online platform for startups, developed to promote business, and Stand-up India is the platform that provides loans to SC, ST and women entrepreneurs.