CERSAI Portal Online Registration, Login @ cersai.org.in | CERSAI Search & Certificate Download, Charges, Meaning & Objective – The CERSAI portal was launched to prevent frauds in situations where properties are used as collateral for loans. In addition, the Central Registry of Securitization Asset Reconstruction and Security Interest of India (CERSAI) was set up in pursuance of section 20 of the Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002. In today’s article, we are going to provide you with all the important information related to CERSAI Portal, like for what purpose it has been started and what are its benefits and eligibility etc. (Also read- (रजिस्ट्रेशन) बाल आधार कार्ड: ऑनलाइन आवेदन, ब्लू आधार कार्ड एप्लीकेशन फॉर्म)

About CERSAI Portal

The CERSAI portal was launched by the central government to prevent mortgage frauds. Through this, the process of obtaining multiple loans from different banks on the same piece of land by the fraudster is investigated. In addition to the domestic base also served by this portal, the central government, public sector banks (PSBs), and the National Housing Bank collectively own the majority of shares in CERSAI (NHB). In addition, CERSAI registration is covered as per the Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest Act 2002.[Read More]

Overview of CERSAI Portal

| Portal Name | CERSAI Portal |

| Launched By | by the central government |

| Year | 2024 |

| Beneficiaries | citizens of the country |

| Application Procedure | Online |

| Objective | To prevent mortgage fraud |

| Benefits | Mortgage fraud will be stopped |

| Category | Central Government Schemes |

| Official Website | https://www.cersai.org.in/CERSAI/home.prg |

Objectives of CERSAI Portal

The main objective of the CERSAI Portal is to act as a registration system, through which a KYC Registry is run and maintained. Additionally, it is governed by the PML Regulations of 2005, with over 35 crore KYC records stored in the Central KYC Records Registry. All data is included in the Online Security Interest Register for India on loans, making it easy for borrowers and lenders to get relevant data. All interest generated by banks on any securities is also required to be reported to the government, with the CERSAI portal serving as a venue for the submission of that data. Fraudulent activity associated with Equitable Mortgage is tracked by offering technology data transparency. (Also read- ESIC Scheme: Employee State Insurance Corporation Benefits & Eligibility)

CERSAI Ownership

Although the majority share of the company is now with the central government, under this, in March, CERSAI said that since all the functions of the central registry are related to banking activities, the government’s 51% ownership in the Reserve Bank of India (RBI) company Can do. State-run lenders State Bank of India, Punjab National Bank and Bank of Baroda along with National Housing Bank hold the remaining 49% of CERSAI. (Also read- NVSP Portal Login/Registration, Application Status @ nvsp.in, Voter ID Search)

Features of CERSAI Portal

- Banks, Housing Finance Companies (HFCs) and Non-Banking Finance Companies (NBFCs) are involved in every aspect of the operation of the CERSAI Portal.

- Security interests, inter alia, in movable, immovable and intangible assets can also be easily registered in the Lender Central Registry.

- Additionally, there is a CERSAI login, a database of all properties in India that are mortgaged with banks.

- CERSAI also operated and maintained a central KYC records registry till 2016 to serve the reporting entities of RBI, SEBI, IRDA and PFRDA.

Registration Fee for CERSAI

A fixed fee is charged by CERSAI for registration of security interests, under which the cost of registering with CERSAI ranges from Rs.50 to Rs.100. This fee is based on how much money is borrowed and applied to the property.

| Transaction nature | Fees Payable (Excluding Taxes) |

| Creation or modification of security interest in favor of secured creditors / other creditors | Rs.100 for loans above Rs.5 lakh and Rs.50 for loans up to Rs.5 lakh |

| Satisfaction of securitization or reconstruction of financial assets | Rs 50 |

| satisfaction of any existing security interest | nil |

| securitization or reconstruction of financial assets | Rs 500 |

| assignment of receivables | Rs.10 for assignment of receivables below Rs.5 lakh and Rs.100 for assignment of receivables of Rs.5 lakh and above. |

| Search for information in CERSAI | Rs 10 |

| Waiver of delay up to 30 days for assignment of receivables | Ten times the basic fee, as applicable. |

| Satisfaction of registration on realization of receivables | Nil |

Benefits of CERSAI Portal for Homebuyers

The options for property and real estate developer verification were restricted prior to the implementation of the Real Estate (Regulation and Development) Act, 2016. Homebuyers were duped under the guise of deceitful tactics and false promises, through this it can now be verified by the prospective homeowner, that the property shortlisted by them is free from any encumbrances or encumbrances on the CERSAI platform Not used as collateral for the loan. Homebuyers save pesos as well as avoid tedious future legal difficulties.

CERSAI Database Update and Maintenance

The CERSAI database is updated with the help of Indian banks and other financial organizations, with the CERSAI database being updated every time a bank needs to be updated with new information. When any loan is processed and disbursed by him, the database update is recognized as registration fee. The purpose of the Registry of Encumbrances is to keep an open database of encumbrances on properties, banks are required by law to provide information regarding loans disbursed within 30 days of completion of the loan. In addition, the Reserve Bank of India (RBI) will impose financial penalties on banking institutions for not updating the CERSAI database.

Procedure to Login on CERSAI Portal

All the citizens of the state who want to login under CERSAI Portal can login under this portal by following the following procedure:-

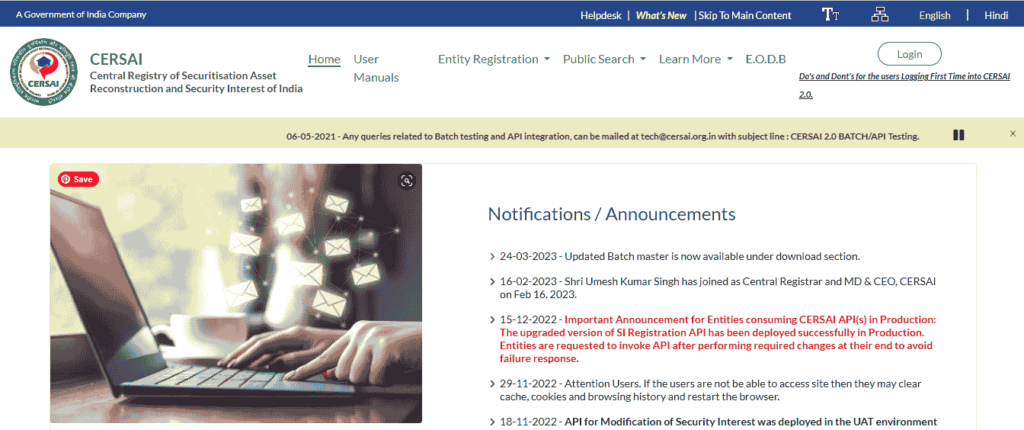

- First of all you have to visit the official website of CERSAI, after that the homepage of the website will open in front of you.

- On the homepage of the website, you have to click on the option of login, after that the next page will open in front of you.

- Here you have to enter the details of the asked information like login ID, password and captcha code etc.

- Now you have to click on the option of login, by following this process you can login under this portal.

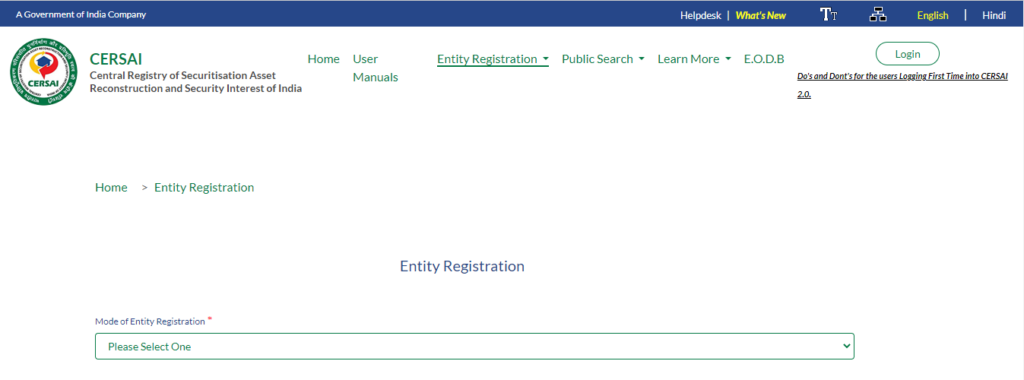

Procedure for Unit Registration on CERSAI Portal

- First of all you have to visit the official website of CERSAI, after that the homepage of the website will open in front of you.

- On the homepage of the website, you have to click on the option of View More from the unit registration section, after that the next page will open in front of you.

- Here you have to choose the mode of unit registration, after that, enter all the required details.

- Now you have to enter captcha, after that you have to click on the submit option, by following this process you can register a unit on this portal.