Employees’ Provident Fund (EPF) Eligibility, Withdrawal & Menber Passbook | EPF Interest Rate & Contribution Rate – A famous savings program called EPF has been started under the direction of the Central Government. Through this program, the salaried class encourages their saving behavior, and through this helps them build up a sizable retirement corpus. In today’s article, we are going to provide you with all the important information related to Employees’ Provident Fund Scheme, like what is the main objective of this scheme, and what are its benefits and eligibility, etc. [Also Read- UP COVID-19 Test Results Online: CORONA Test Lab Report at labreports.upcovid19tracks]

Employees’ Provident Fund Scheme

Employees’ Provident Fund Scheme was established by the Central Government in 1952, it is a retirement benefit program. Under this scheme, monthly contributions are made by the employer and the employee till retirement, through this various tax benefits are provided to all the employees. Apart from this, it also provides a comparatively higher rate of interest to all the employees as compared to other savings schemes. A monthly contribution equal to 12% of basic salary and dearness allowance is also provided by the employee and employer through EPF. The scheme covers 8.33% of the total employer’s contribution (12%). [Also Read- UP COVID-19 Beds Availability Status: CORONA Beds Free Beds Dashboard]

Overview of Employees’ Provident Fund Scheme

| Scheme Name | Employees’ Provident Fund Scheme |

| Launched By | Employees’ Provident Fund Organization |

| Year | 2024 |

| Beneficiaries | employees of the country |

| Application Procedure | Online |

| Objective | Opening of EPF account of each employee |

| Benefits | EPF account of each employee will be opened |

| Category | Central Government Schemes |

| Official Website | https://www.epfindia.gov.in/site_en/index.php |

Objectives of Employees’ Provident Fund Scheme

The main objective of EPF is to open an EPF account of each and every employee, the rules and regulations of EPF should be followed regularly by the business of all the employees. Apart from this, it should be very easy to comply with, along with this, all the employees of the country should have easy access to EPF accounts. Apart from this, through the Employees’ Provident Fund Scheme, improving the infrastructure of all employees and the dependence on internet services will also be ensured. Apart from this, the claim settlement period of 20 days will be reduced to 3 days through this scheme. [Also Read- Lockdown Pass: State wise COVID-19 E Pass Registration, UT’s List]

Benefits of EPF

- Employees are encouraged to save through the Employees’ Provident Fund Scheme launched by the Employees’ Provident Fund Organization.

- Through this program, some deduction is made every month from the salary of all the employees of the country, through which significant savings can be made over a long period of time.

- Apart from this, since the introduction of this scheme in the country, it is not mandatory for the employees to make a single, lump sum investment.

- Through EPF, all the employees will be able to get financial benefits in their time of crisis, due to which they will not have to face any problem.

- Through this scheme, the standard of living of all the employees of the country will be improved, along with this, the amount saved through this scheme can be used by the employees during retirement.

Employee Provident Fund Organization

Through EPF in the country, all the employees of the country will be encouraged to save money separately for retirement. This organization was established by the Central Government in 1951, which is monitored by the Ministry of Labor and Employment, Government of India.

Universal Account Number (UAN)

All the EPF members of the country can easily access their PF accounts online, through these accounts all the employees can make withdrawals and check their Employees Provident Fund balance along with many other tasks easily. Additionally, accessing the EPFO member portal has been made very easy and simple by Universal Account Number (UAN), a unique 12-digit number, also known as UAN, provided by the organization to all members. Is. On the contrary, in case of change of employers, the UAN of the employee does not change even after that. All the employees of the country have to activate their UAN to use the online services.

EPF Interest Rate 2024

PF interest rates are currently 8.10 per cent for the financial year, under this it is very easy and simple to calculate the amount of interest deposited in the EPF account at the end of the financial year. In addition, the total balance in the account is calculated at the end of the year by adding the employer’s and employee’s contributions.

Employees’ Provident Fund Contribution Rate

The categories in which the contribution is made by the employers are as follows:-

| Category | Contribution Percentage(%) |

| Employees Provident Fund | 3.67 |

| Employee’s Deposit Link Insurance Scheme (EDLIS) | 0.50 |

| Employees’ Pension Scheme (EPS) | 8.33 |

| EDLIS Admin Charges | 0.01 |

| EPF Admin Charges | 1.10 |

Types of EPF Form

Following are the different types of Employees Provident Fund forms and their uses:-

| Form Type | Form Use |

| Form 31 | The PF Advance Form is another name for it. It can be utilized to get EPF account withdrawals, loans, and advances. |

| Form 10D | A monthly pension may be requested using this form. |

| Form 10C | To make a benefit claim under the EPF program, utilize this form.The money the employer contributes to EPS is withdrawn using Form 10C. |

| Form 13 | The PF amount from your prior work is transferred to your present employer using this form. This aids in maintaining all OF funds in a single account. |

| Form 19 | To request the ultimate settlement of an EPF account, utilize this form. |

| Form 20 | If the account holder passes away, the family may utilize this form to withdraw the PF amount. |

| Form 51F | A nominee may use this form to claim benefits under the Employees’ Deposit Linked Insurance. |

Eligibility Criteria for EPF

- If their monthly take-home is less than Rs.15,000, then it is mandatory for the salary employees to open an account in the Employees’ Provident Fund.

- Apart from this, companies with less than 20 employees can also voluntarily participate under this program.

- On the contrary, if an organization provides employment to more than 20 citizens, it is mandatory by law to register for the EPF programme.

- The benefits of the EPF system exist for the whole of India except for the states of Jammu and Kashmir.

- Employees of the country who earn more than 15,000 per month can open an EPF account by taking permission from the Assistant PF Commissioner.

Different Ways to Check EPF Balance

Citizens who want to check EPF balance can check their EPF balance in the following ways:-

- Missed Call Service:- Citizens who want to check EPF balance can use missed call service by dialing 011-22901406 from the registered phone number.

- UMANG App:- Unified Mobile Application for New-Age Governance (UMANG) app can be downloaded by all employees to check their EPF balance. Through this app all citizens can check EPF balance as well as submit and monitor claims.

- SMS Service:- All employees can also check their EPF balance through SMS by sending a message to 7738299899 in case you have activated UAN.

- EPFO Portal:- The portal can also be used by EPFO members to check their EPF balance, under this you should use your UAN and password to login to EPF.

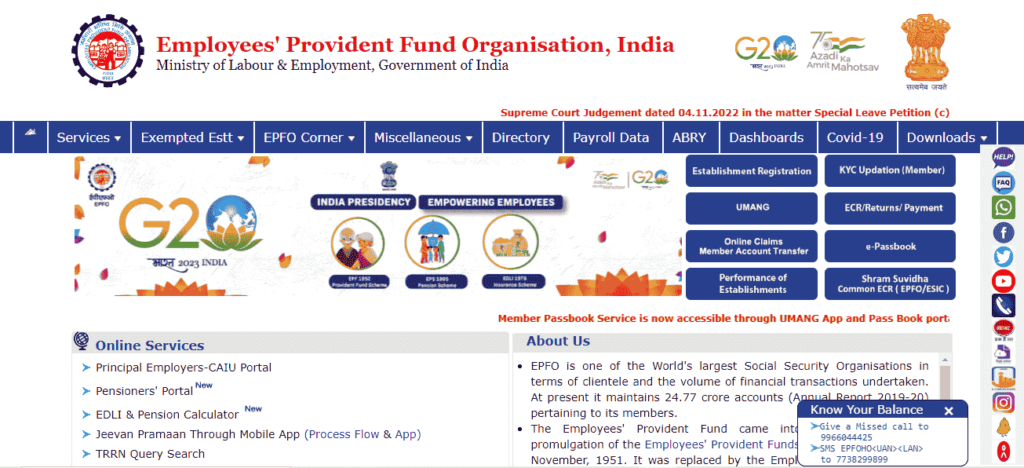

Employer’s EPF Online Registration Procedure

Citizens of the country who want to register EPF can register under it by following the following procedure:-

- First of all, you have to go to the official website of the Employees Provident Fund Organization, after that the homepage of the website will open in front of you.

- On the homepage of the website, you have to click on the option of installation registration, after that the next page will open in front of you.

- Here you have to accept the terms and conditions, now the registration form will be displayed in front of you.

- In this form you have to enter the details of all the information asked, after that, an email e-link and a mobile PIN will be sent to your registered email ID which has to be activated.

- After this you have to upload all the requested documents, after that you have to click on the submit option.

Procedure to Transfer EPF Money

- First of all, you have to go to the official website of the Employees Provident Fund Organization, after that the homepage of the website will open in front of you.

- On the homepage of the website, you have to click on the registration option, after that the next page will open in front of you.

- Now you have to enter the details of all the information asked in the form, after that you have to go to the online transfer claim portal.

- Now, you have to request for EPF transfer, if you are eligible to do so, you can submit a transfer claim online without submitting Form 13.

- Then you have to click on the option of Request for Transfer of Funds, now you have to enter all the required previous employment details.

- Get it certified by your old or new employer and submit it, now you have to click on submit option.

- After this a tracking ID will be sent to your registered mobile number, finally, track your application through the tracking ID received.

EPF Passbook

The EPF account statement can be viewed by all the employees, as well as the account statement can be printed or downloaded by them using the EPF Passbook facility. Passbook facility is available to all the members who have registered their UAN on EPFO portal. In addition, information such as employee name, establishment ID, scheme details, office name, etc. are included in the EPF passbook.

EPF Withdrawal Protocols

All members can opt to withdraw their EPF in full or in part, such withdrawal is allowed only under certain circumstances. The situations where people can withdraw their EPF are as follows:-

- Post retirement

- When transitioning between jobs or changing careers. However, the time spent unemployed must exceed two months.

- If they have been unemployed for more than two months.

Partially EPF Withdrawal Protocols

The situations where people can partially withdraw their EPF are as follows:-

- For a wedding

- To buy land or build a house

- Home loan repayment

- For higher education

- Renovation of a residential property