E Pan Card Apply Online | Instant E Pan Card Application Form | How to Get Instant Duplicate Pan Card

In today’s fast-paced life, everyone runs towards easy things, looking for easy ways to do any work. In such a situation, for the application of necessary documents like PAN card, keeping this policy in mind, the facility of Instant E Pan Card Application has been started. In this article, all the information about this instant e-pan card has been given in detail, and many important aspects have also been shared, such as its benefits, eligibility, required documents, application process etc. Any citizen who wants to take advantage of this Instant Pan Card facility, read this article completely. [Also Read – Stand Up India Loan Scheme: Apply Online, Login & Application Status]

Instant E- PAN Card

PAN card is a very important document, which is very much needed in today’s time. This document is useful for many types of convenience. A new facility has been launched by the country’s Finance Minister Nirmala Sitharaman in the Budget, in which citizens will be able to get a permanent account number instantly through their Aadhaar number without submitting any application form. This has been named as Instant E Pan Card. By getting the PAN number from this facility, the citizen can use this PAN card anywhere according to his need. There is no charge for instant e-pan cards, this facility is absolutely free.[Read More]

Overview of Instant Pan Card

| Name | Instant E Pan Card |

| Launched By | By the country’s Finance Minister Nirmala Sitharaman |

| Year | In 2024 |

| Beneficiaries | All Citizens of the Country |

| Application Procedure | Online |

| Objective | Providing instant facility to the people |

| Benefits | Instant Pan Number |

| Category | Central Government Schemes |

| Official Website | https://www.onlineservices.nsdl.com/paam/ |

Objective of Instant E-Pan Card Application

Every citizen residing in the country needs a PAN card to file income tax returns, to open a bank account or demat account, to apply for a debit or credit card, etc. For which they have to apply, then after about 10 days the citizens get the PAN card. Many times such a situation also arises, in which a PAN card is needed soon, but PAN card is not available. In view of such a situation, a new facility has been introduced by Finance Minister Nirmala Sitharaman in Budget, under which citizens will be able to get this Instant Pan Card in an instant without submitting any application form, only through Aadhaar number.[Read More]

Linking E-PAN with Aadhar Card

The government will immediately issue PAN cards in PDF format so that people do not face any problem. This PDF format consists of QR code, which includes details like applicant’s name, date of birth and photograph. To download this Instant E Pan Card, the applicant can use the Pandra digit acknowledgment number on the income tax e-filing portal. After this the soft copy is sent to the registered email. Other websites are also available for PAN cards, such as NSDL or UTITSL. There is a fee to be paid while applying for e-PAN on these websites, and no fee is to be paid while applying for e-PAN on the Income Tax e-filing portal.[Read More]

Essential Points of Instant Pan Facility

- The applicant applying under this scheme must have a valid Aadhar card which is not linked to any other PAN.

- The mobile number entered by the applicant in the registration form should be the same mobile number linked with the Aadhar card.

- Apart from this, the applicant does not need to submit or upload KYC documents under this scheme.

- The person applying under this scheme should not have more than one PAN.

Important Dates

The government has kept the last date for linking Aadhar card with PAN card as 30 June, under which citizens should link their Aadhar card with PAN card. PAN cards will be activated by linking. If Aadhar card is not linked with PAN card then PAN card will be made ineligible by the authorities. [Also read- नरेगा जॉब कार्ड लिस्ट: नई MGNREGA कार्ड सूची, NREGA Card डाउनलोड]

Benefits of Instant E Pan Card

With the implementation of the facility of Instant E Pan Card application, citizens will get the following benefits: –

- With the successful implementation of this facility, people can apply for a PAN card sitting at home.

- The main advantage of this e-PAN card is that it will be available in our device as a softcopy PAN card.

- Due to being a softcopy PAN card, there will be no need to go anywhere to print it.

- This Instant E Pan Card is absolutely paperless.

- Now with the Instant Pan Card facility becoming online, citizens will not have to go to any office.

- Now citizens will not have to wait for hours or days for a PAN card.

- If applying for e-PAN on the Income Tax e-filing portal, then no fee will be required to be paid.

- By applying for a PAN card through an online income tax e-filing portal, your Aadhar card will be automatically linked with your PAN card.

Eligibility under Instant E Pan Card

- Those who already have a PAN card document will not be able to apply for an e-PAN card.

- Only permanent residents residing in India are eligible for this e-PAN card facility.

- Citizens above 18 years of age are eligible to apply for this document.

- This e-PAN card facility is not applicable for HUFs, Firms, Trusts and Companies.

Documents Required for Instant Pan Card

- Aadhar card

- Permanent proof of residence

- Passport size photograph

- Signature of Applicant

- Domicile certificate

- Voter ID Card

- E mail ID

- Mobile number

- Working aadhar card number

Application Process for Instant Pan Card

Citizens who want to apply for this Instant PAN card document, they have to use the simple steps mentioned below: –

- First of all you have to visit the official website of the “Income Tax Department”. After this the homepage of the website will open in front of you.

- On the homepage of the website, you have to click on the option of “Instant e-PAN” from the section “Our Services”. After this you will see two options here:

- Apply for new pan

- Update pan

- Out of these, you have to select the option of “New PAN“. After that a new page will be displayed in front of you.

- Now on this page you have to enter your Aadhar number, and click on the “Continue” button.

- After clicking, OTP will be sent to your active mobile number, which you have to enter in the “OTP box”, and check your Aadhaar details.

- Once you have verified the Aadhaar details, you have to click on the “Submit” button, and your PAN card will be sent by email.

Procedure to Apply for Instant PAN Through Aadhaar

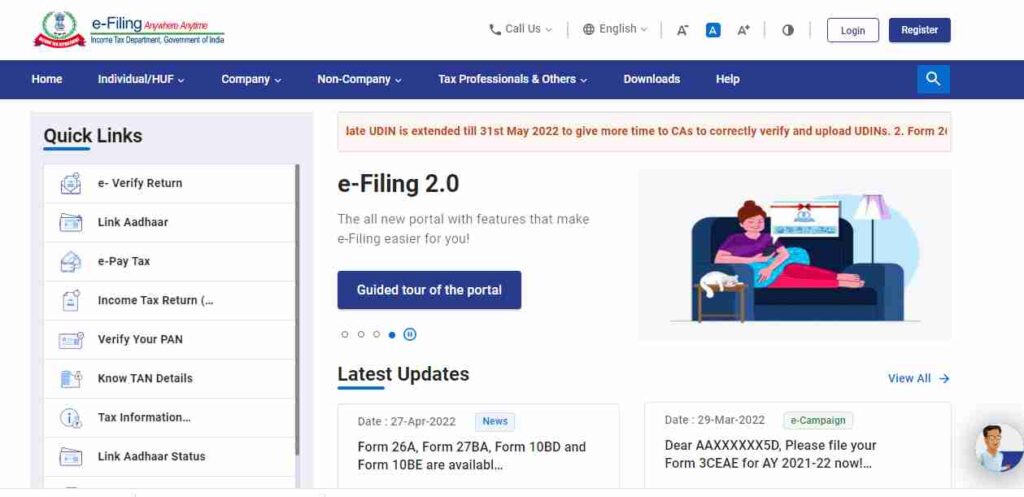

- First of all you have to go to the official website of e-filing. After that the homepage will open in front of you.

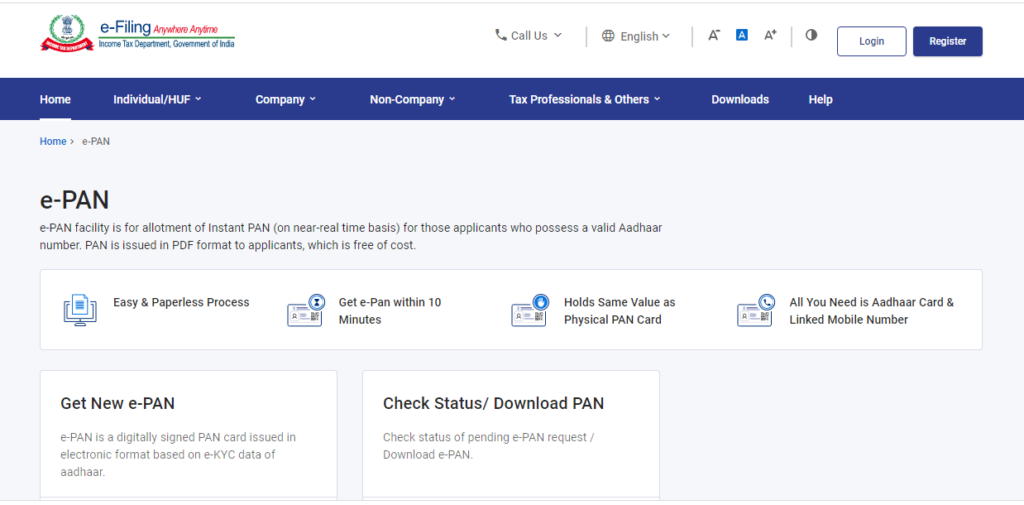

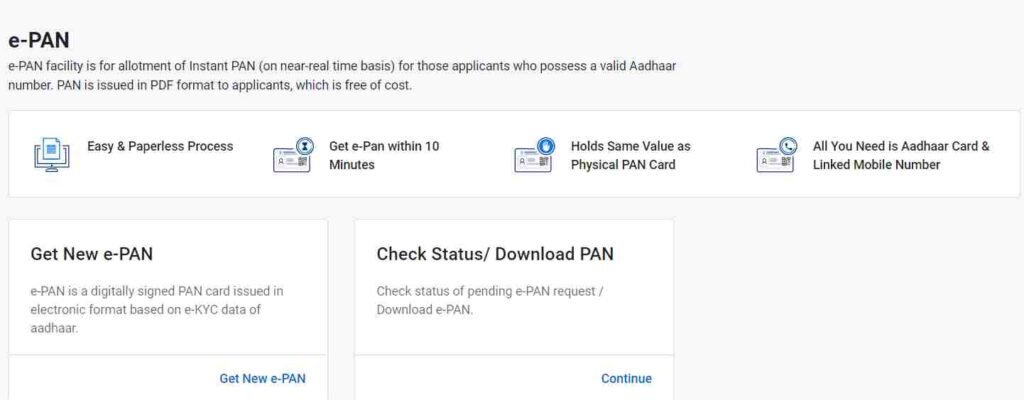

- On the homepage of the website, you have to click on the option of Instant e-PAN from the Quick Links section. After that a new page will be displayed in front of you.

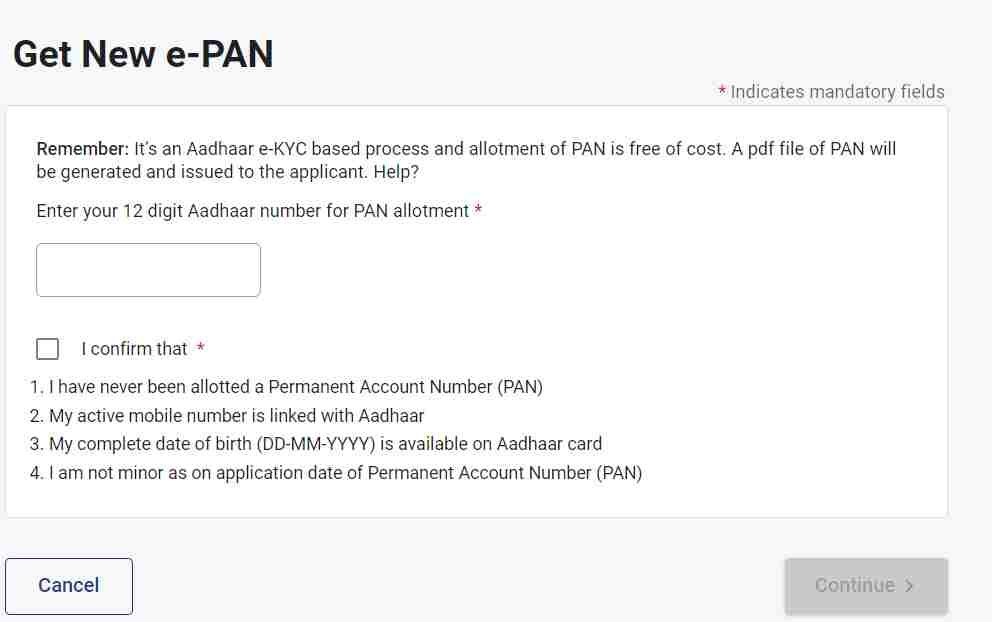

- Now on this page you have to click on the option of Get a New e-PAN. After that a new page will be displayed in front of you.

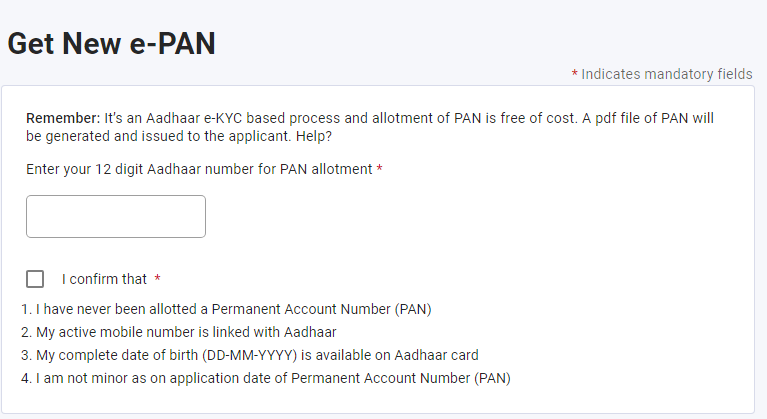

- On this page, you have to enter your Aadhaar number, and tick the declaration. After that you have to click on the continue button.

- After this you will receive an OTP on your registered mobile number. After entering it, you have to click on Validate Aadhaar OTP.

- Let’s click on the continue button. Now a new page will open in front of you, where you have to tick the checkbox, and accept the terms and conditions.

- Once accepted, you have to click on the Continue button. After that you have to enter OTP, and click on the continue button.

- Now you have to verify your email ID by clicking on a valid email ID, after that you have to tick the check box, and click on the continue button.

- You will have to submit your Aadhaar details for verification, after which you will receive an acknowledgment number. You can check the status of PAN allotment by entering your Aadhaar number.

Check Status / Download Instant PAN

- First of all you have to go to the official website of e-filing. After that the homepage will open in front of you.

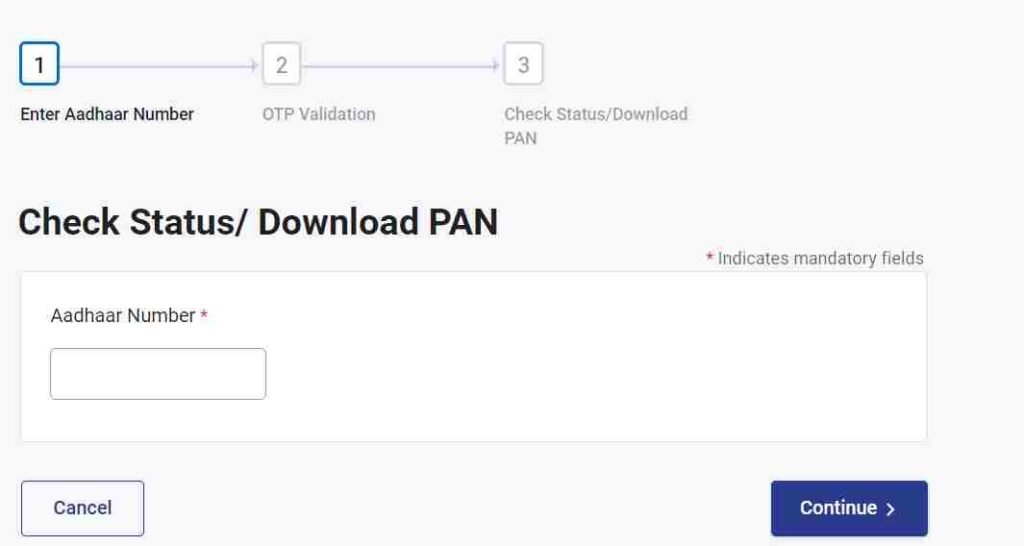

- On the homepage of the website, you have to click on the option of Instant e-PAN from the Quick Links section. After that a new page will be displayed in front of you.

- Now on this page you have to click on the option of Check Status / Download PAN. After that a new page will be displayed in front of you.

- On this page you have to enter your Aadhaar number, and click on the option to continue. After that you have to enter OTP and click on Continue.

- After this a new page will open in front of you, where you can check the status of your PAN allotment request.

- If your PAN allotment is successful, a PDF link will be generated within 10 minutes to download your PAN file

- The PAN file containing your PAN is password protected, so to open this PDF file use your date of birth as the password, like this DDMMYYYY.

Procedure to view Application Status

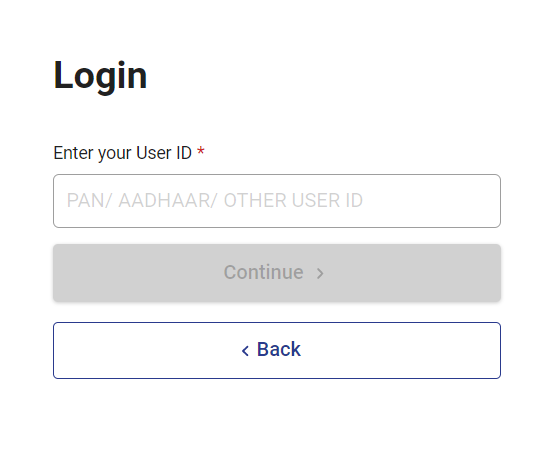

- First of all you have to visit the official website of the “Income Tax Department”. After this the homepage of the website will open in front of you.

- On the homepage of the website, you have to click on the login option. After this the next page will open in front of you.

- Here you have to enter your acknowledgment number, after which your PAN card will be provided to you after filling the application.

- After this, you have to enter the captcha code and click on the submit option, now the application status will be displayed in front of you.