IGR Maharashtra Inspector General of Registration, Services List @ igrmaharashtra.gov.in – Many portals are started by the governments of many states of the country to get information related to their property to all the citizens of their state. Now recently, the Government of Maharashtra has also announced the launch of a similar portal, which is named igrmaharashtra.gov.in Portal. Through the IGR Maharashtra, all the citizens of the state can get information related to their property. Apart from this, land record details, stamp duty calculation, payment, stamp duty refund etc. facilities and benefits can be availed by all citizens of the state through this portal.[Also read- RTE Admission Maharashtra: Admission Form, Fee, Last Date]

What is IGR Maharashtra

The IGR Maharashtra portal has been started by the Government of Maharashtra with the aim of providing benefits to the citizens of their state, through this portal all the citizens of the state can get all the information related to their properties. Apart from this, let us tell you that the office of Inspector General of Registration and Ticketing is IGR Maharashtra in Maharashtra. This office deals with all state registration fee payment, stamp duty refund, marriage registration, property documents registration, stamp duty payment, property valuation, property tax calculation, stamp duty amount calculation, stamp duty etc. [Also read- MHADA Lottery: Application Form, Lottery Registration, Draw Date][Read More]

प्रधानमंत्री नरेन्द्र मोदी योजना

Overview of IGR Maharashtra

| Portal Name | IGR Maharashtra |

| Launched By | By Maharashtra government |

| Year | 2024 |

| Beneficiaries | Citizen of Maharashtra State |

| Application Procedure | Online |

| Objective | Providing all the citizens of the state their property related information at one place |

| Benefits | All the citizens of the state will be provided information related to their property. |

| Category | Maharashtra Government Schemes |

| Official Website | Click Here |

Objective of igrmaharashtra.gov.in Portal

The main objective of IGR Maharashtra is to provide all the citizens of Maharashtra state with their property related information at one place. It is a Registration and Ticket Inspector General, in addition this portal is a digitally registered department started by the state government. Through this, the citizens of the state will not have to face the hassle of visiting the sub-registrar offices for verification of property paperwork. Apart from this, contemporary techniques will be used by the Maharashtra State Department for registration and collection of papers in the state in a timely and transparent manner through igrmaharashtra.gov.in portal. [Also read- Mahadbt Scholarship: Apply Online Form, Last Date, Eligibility][Read More]

Standardization of Land Records By IGR Maharashtra

The Revenue Department of the Government of Maharashtra has been very successful during a recent development in standardizing the land records system of the state. Under this, the department has been successful in bringing uniformity in making the land records error free, this success has been achieved by the department by bringing uniformity in the terminology of land records. Apart from this, the terminology used is very essential in the land records management system, because different words are used in different areas. Keeping this in mind, the department has brought uniformity in the terminology of land records. [Also read- Maharashtra Ration Card List: [mahafood.gov.in] महाराष्ट्र राशन कार्ड सूची][Read More]

Online facilities under IGR Maharashtra

Many facilities are provided to the citizens of the state through IGR Maharashtra, started by the Government of Maharashtra, out of which some facilities can also be accessed online, some of these facilities are as follows:-

- Mortgage deed e-filing “It is available for banks as well as users”

- marriage license

- property valuation

- Sub-Registrar Time Slot Booking

- Property e-registration “First sale only” From March onwards, this facility can be availed by only certain developers and MHADA.

- Stamp duty application and related services like refund, etc.

How to Calculate Stamp Duty under IGR Maharashtra

Stamp duty is a tax payable for registering a legal document with the government. It is a type of tax which is paid by the individual on different documents. Under which certain leave, license agreement, gift deed, mortgage deed, property sale agreement etc. have been included. Also in Maharashtra State 3% to 6% value of Stamp Duty is for the entire transaction, this document varies completely with some things like locality and other considerations this paper varies from these. Stamp duty is calculated online through IGR Maharashtra, under which the stamp duty can be determined through the website of Maharashtra started by the Government of Maharashtra. [Also read- Mahajob Portal| Online Registration at mahajobs.maharashtra.gov.in]

Under this, if you also want to estimate the stamp duty, then for this you will have to enter the data of all your important documents. Apart from this, we are going to provide you with complete information about how you can calculate stamp duty in this section, you can calculate stamp duty by following this process. The process is as follows:-

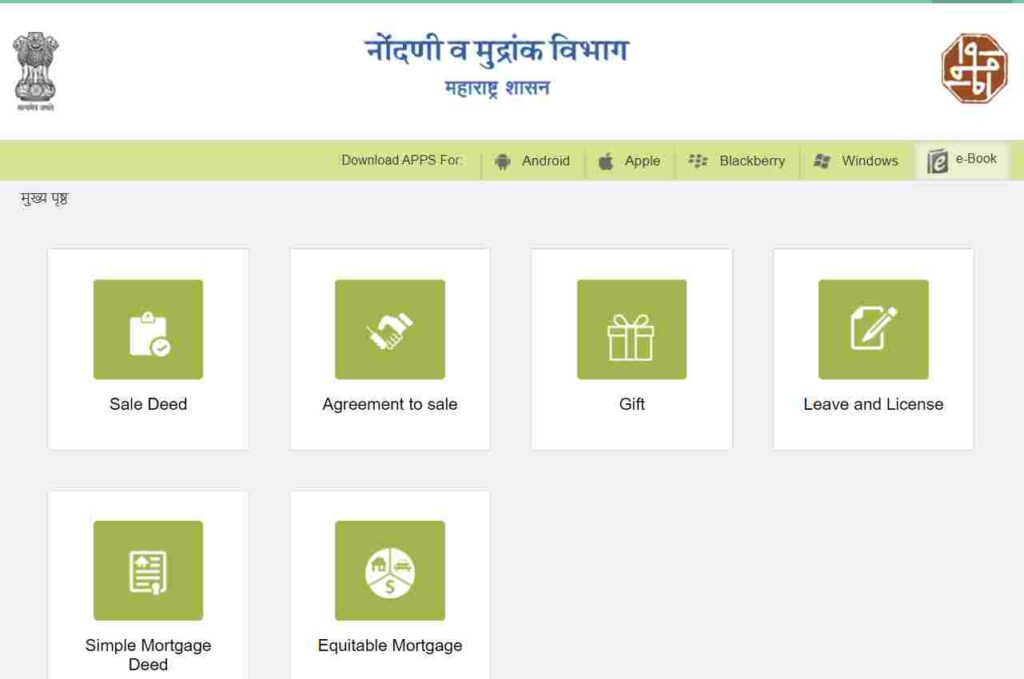

- First of all you have to go to the official website of IGR Maharashtra. After this the homepage of the website will open in front of you.

- On the homepage of the website, you have to click on the option of Stamp Duty Calculation from the section of Online Services Area. After this the next page will open in front of you.

- Here you have to click on the option of sale deed. After this two options will be displayed in front of you. One is agreement to sell, second permission and license etc.

- Out of these, if it is an agreement to sell, then you have to click on the option of agreement to sell the option. Apart from this, if it is permission and license, then you have to click on the option of permission and license.

- Now you have to choose the type of documents, after that you have to select the municipality.

- After this, you have to enter the amount of consideration and the market value, now you have to click on the option to calculate.

- Then the stamp duty calculation will be displayed in front of you. By following this procedure you can see the stamp duty calculation.

Procedure to View Property Registration Details

Any citizen of Maharashtra state can get information about any of his property through igrmaharashtra.gov.in portal, but through this only property information can be seen which will be registered in Maharashtra state. Apart from this, it has become very easy for the citizens to get the information of all the properties registered in Mumbai city and its suburban limits since 1985. Under this, information for areas other than Mumbai became available for the first time in the year 2002. Under this, information from 1985 to 2002 is available for a limited number of areas other than Mumbai. Under this, we are going to provide you the process of finding the property registration details in this section, which is as follows:-

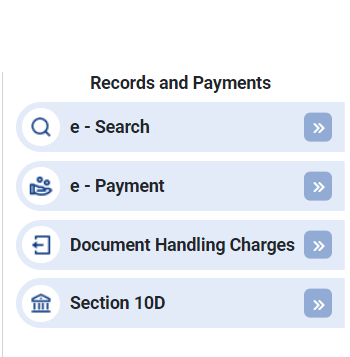

- First of all you have to go to the official website of IGR Maharashtra. After this the homepage of the website will open in front of you.

- On the homepage of the website, you have to click on the option of e-search and choose a free process to take the car. After this the next page will open in front of you.

- Here you have to create an account if you are not a registered user and after that you have to click on the login option on the homepage of the website. After this a new page will be displayed in front of you.

- Now you have to enter the captcha code, after that you have to select the location of the property from Mumbai, other urban areas or Maharashtra.

- After this, you have to enter the year of registration, district, tehsil, village and property number etc. After this, if you see that the specific property number is not available, then you have to enter the survey, plot or CTS number under it .

- Then you have to select the property from the list. Now you have to select the appropriate Property Index II. Now a PDF will be displayed in front of you with the registration information. You can download it also.

Maharashtra Taxes & Fees under igrmaharashtra.gov.in Portal

Under this, when the stamp duty is determined, after that any citizen of the state can make online payment using the IGR Maharashtra system. Apart from this, the registration fee is also accepted under the IGR Maharashtra started by the Government of Maharashtra. Under this, payment can be made by the user both online and offline. On the contrary, if a person has not been registered, then payment can be made by them without registering, under this the process of making payment is as follows:-

- First of all you have to go to the official website of IGR Maharashtra. After this the homepage of the website will open in front of you.

- On the homepage of the website, you have to click on the option of Inspector General of Registration. After this the next page will open in front of you.

- Here two options will be displayed in front of you whether you want to pay with login or without registration.

- You can click on the option to pay without registration for ease. After this you have to select the mode of payment, stamp duty alone, registration fee only, or both stamp duty and registration cost etc.

- After this you have to select the applicable property district, sub-registrar office with authority over the property, type of documents, and now you have to enter the stamp duty calculated amount.

- If under this the option of registration fee is also selected, then under this the user has to enter the registration fee otherwise. In addition, 1% of the value under this registration cost is the consideration of the declaration of the document.

- Then you have to enter the property and the relevant information on both sides, and choose the payment method. Acceptable online payment options are Credit/Debit Card and Internet Banking.

- The site allows users unfamiliar with online payment options to submit challans and pay the required amount in cash or check at designated bank locations. After this you have to click on the submit option, thus your process will be completed.

Procedure For Obtaining A Digital Copy Of The Register Office

- First of all you have to go to the official website of IGR Maharashtra. After this the homepage of the website will open in front of you.

- On the homepage of the website, you have to click on the option of e-search, after that you have to click on the option of e-search from the section of online services.

- Now a drop menu will be displayed in front of you, under which you can also select a payment option to proceed.

- You will then be allowed to do an online document search through the IGR Maharashtra website. Now you will reach the homepage of this website.

- A new page will be displayed in front of you, here many options will open in front of you, you have to choose any one option to continue the online document search.

- Here you have to select your district and after that you have to enter 3 letters of your area as well as you have to click on the submit option.

- You have to click on all the requested information, after that you have to click on the search option, after which the results will be displayed in front of you.

- This is a paid service to obtain a digital copy of the Register Office, for which you have to pay using the e-payment option from the section on the online services link on the homepage of this website, once you have completed the payment After that you can successfully get a digital copy of the register office.

Procedure to Check Refund Status

A user is allowed to file for Stamp Duty Refund through IGR Maharashtra in a smooth and online manner. Under this, citizens can easily apply for stamp duty refund, in this the process of applying for stamp duty refund is as follows:-

- First of all you have to visit the official website of igrmaharashtra.gov.in Portal. After this the homepage of the website will open in front of you.

- On the homepage of the website, you have to click on the option of Stamp Duty Refund. After this the next page will open in front of you.

- Here you have to enter the details of all the asked information such as refund token number and password etc.

- After this, the details of the refund status will be displayed in front of you on the new page. You can check the status of the refund by following this procedure.

How to Check Ready Reckoner Rates Online

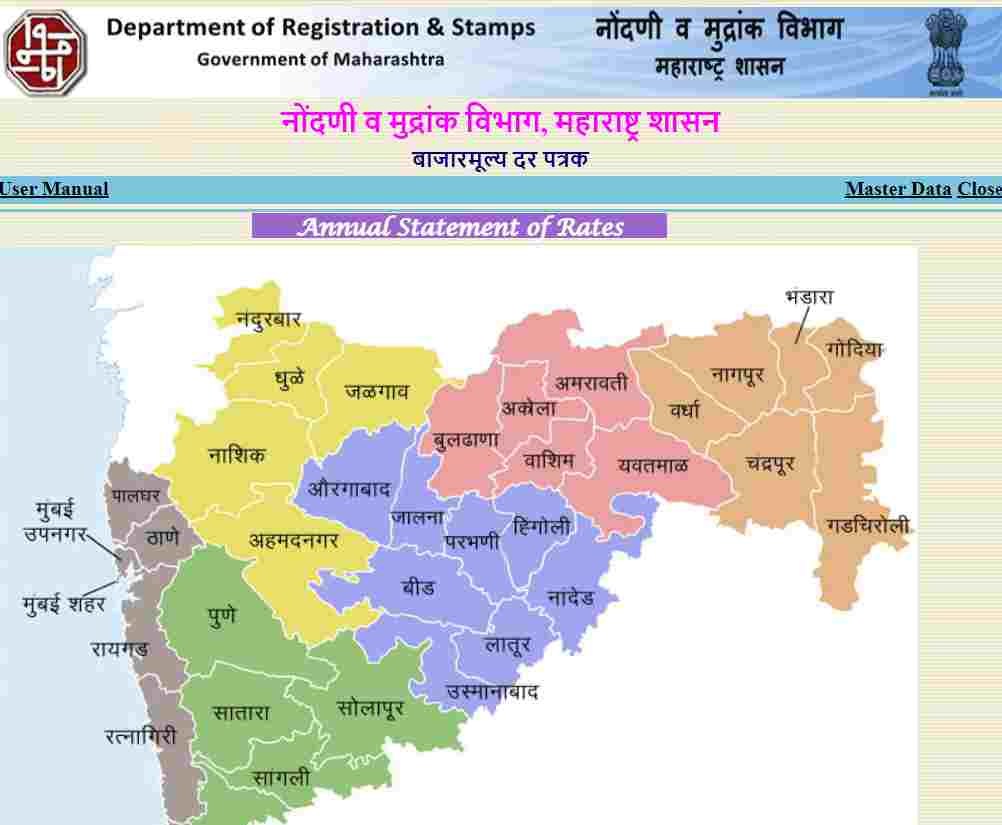

Through this portal the state government allows a user to check the latest ready reckoner rates online. Apart from this, let us tell you that the ready reckoner rates are fixed by the Maharashtra government, the ready reckoner rates are those rates. Below which property transactions cannot take place in a specified area. Apart from this, these rates are revised from time to time by the state government. Under this, if you want to check online ready reckoner rates, then in this section we are going to tell you the process to check online ready reckoner rates, which is as follows:-

- First of all you have to visit the official website of igrmaharashtra.gov.in Portal. After this the homepage of the website will open in front of you.

- On the homepage of the website, you have to click on the option of e-ASR 1.9 from the section of e-ASR. After this the next page will open in front of you.

- Here a map will be displayed in front of you, on this map, you can select the respective district for which you want to know the ready reckoner rates.

- After that a new page will be displayed in front of you. On this page, select the district, taluka and village in front of you and the evaluation type, evaluation range, and rates etc. will be displayed.