edit Guarantee Scheme Application Form | Credit Guarantee Scheme Eligibility | Credit Guarantee Scheme Interest Rate | CGTMSE Scheme PDF Download

From time to time, the Government of India keeps on launching various schemes to encourage self-employment. Under these schemes, the central government provides financial assistance to entrepreneurs to increase their business. One of these schemes is the Credit Guarantee Scheme (CGTMSE), under which bank credit will be provided to the entrepreneurs. Beneficiary entrepreneurs can set up their own industrial units using this bank credit. Today, through this article, we will tell you about all the necessary information related to this scheme. [Also read- नरेगा जॉब कार्ड लिस्ट: नई MGNREGA कार्ड सूची, NREGA Card डाउनलोड]

Credit Guarantee Scheme – CGTMSE

CGTMSE Scheme has been started by the Ministry of Micro, Small and Medium Enterprises of the Central Government, through which efforts will be made to strengthen the credit distribution system and facilitate the flow of credit in the MSE sector. With the help of this scheme, the entrepreneurs will be provided a loan without any collateral or third party guarantee by the bank. Under this scheme launched by the Government of India, loans will be provided by banks to the first generation entrepreneurs, so that the entrepreneurs can easily set up their own units of micro and small enterprises. For the purpose of implementing this scheme, the Central Government and SIDBI have jointly established a Credit Guarantee Fund Trust for Micro and Small Enterprises. [Also read- Agneepath Scheme: Apply Online, Agniveer Army Recruitment Eligibility, Full Details]

Credit Guarantee Scheme Extended

It is known to all that Finance Minister Sitharaman ji has announced to extend the emergency credit line guarantee scheme till March in her budget on February 1. Through this expansion, the government has tried to meet the all-important working capital needs of businesses. More than 1.3 MSMEs will be assisted under this expansion. Under this, the total amount has been increased to 5 lakh crores, which was 50 thousand crores earlier. The amount raised under this will be specially earmarked for providing hospitality and related enterprises.[Read More]

Overview of Credit Guarantee Scheme (CGTMSE)

| Scheme Name | Credit Guarantee Scheme |

| Launched By | Government Of India |

| Year | 2024 |

| Beneficiaries | Citizens Of India |

| Application Procedure | Online |

| Objective | To Provide Credit Guarantee Facility |

| Benefits | Loan will be provided without collateral or third party guarantee |

| Category | Central Government Schemes |

| Official Website | https://www.cgtmse.in/ |

Objectives of CGTMSE Scheme

The main objective of the Credit Guarantee Scheme launched by the Government of India is to provide credit guarantee facility to the entrepreneurs of the country. Through the credit guarantee facility provided under this scheme, the beneficiary entrepreneurs can increase their industry by taking loans from the bank. The central government will provide the benefits of this scheme to the first generation entrepreneurs of the country. In case the entrepreneur is unable to repay the loan availed within the stipulated time, then through this scheme the lender will be paid 50%, 75%, 80%, or up to 85% of the loss incurred by the lender through the credit guarantee trust. [Also read- Agniveer Bharti: ऑनलाइन रजिस्ट्रेशन, 46000 इंडियन आर्मी Agniveer Recruitment]

Types of Credit Guarantee Schemes

- Credit Guarantee Scheme for Banks – This scheme has been started by the Government of India to fund micro and small enterprises. Under this scheme, scheme guarantee has been provided to the borrowers to facilitate through the lending institution in small and micro enterprises.

- Credit Guarantee Scheme for NBFCs- Under this scheme, credit facilities are given to eligible persons in small and micro enterprises through whichever eligible NBFC.

- Sub-credit scheme- Guarantee coverage to scheduled commercial banks is provided under this scheme. Through which banks can give personal loans to the promoters of stressed MSMEs for using equity, sub-debt, quasi-equity etc.

- PM Swanidhi- This scheme has been started by the Government of India to provide assistance to the urban street vendors. Credit guarantee coverage will be given to the lending institutions. Through which they can give credit facilities to street vendors to meet their working capital needs.

Credit Guarantee under Credit Guarantee Scheme (CGTMSE)

Let us tell you that when the loan to the candidate is backed by one party without the need of any external collateral or third party guarantee, then this situation is called credit guarantee. Under the Credit Guarantee Scheme, loans up to a maximum of Rs 2 crore are provided by eligible institutions for free credit facility to both new and existing micro and small enterprises including manufacturing and service enterprises. Under this scheme, the work of guarantee coverage will be made available to selected NBFCS and small finance banks and 50%, 75%, 80% and 85% guarantee cover will be provided for the sanctioned amount. [Also read- PM Modi Yojana: प्रधानमंत्री नरेन्द्र मोदी स्कीम्स लिस्ट | पीएम मोदी सरकारी योजना सूची][Read More]

Steps to avail Loan under the Credit Guarantee Scheme

Candidates have to follow the following four steps to get the loan under the CGTMSE scheme launched by the Government of India:-

- Step 1:- Formation of Business Unit

Candidates must incorporate a private limited company, limited liability partnership, one person company or a proprietorship according to the nature of business before initiating the process of loan approval under the Credit Guarantee Scheme (CGTMSE) introduced by the Central Government. Along with this, it will be mandatory for the candidates to obtain necessary approvals and tax registration for the smooth execution of the project. [Also read- (आवेदन) फ्री सिलाई मशीन योजना रजिस्ट्रेशन फॉर्म, PM Free Silai Machine]

- Step 2:- Preparing a Business Report

After forming the business unit, the candidate businesses need to conduct a market analysis and prepare a business plan with some necessary relevant information, such as business model, promoter profile, projected financials etc. Along with this, the candidate then submits this project report to the credit facility and an application is filed to get the loan under CGTMSE Scheme. Candidate businesses should get this project report prepared by experienced professionals, which increases their chances of getting the project approved. [Also read- PMJAY CSC: Registration, Login, Download Ayushman Card | Mera PMJAY]

Along with this, the project report is then submitted by the candidates to the credit facility and an application is filed to get the loan available under the CGTMSE Scheme.

- Step 3:- Sanctioning of Loan from the Bank

Generally, credit terms and working capital facilities are covered under a bank loan request. After the application of the candidates and the business project is processed, the feasibility of the project is analyzed by the bank and the loan is processed and sanctioned as per the policy of the bank. [Also read- Agneepath Scheme: Apply Online, Agniveer Army Recruitment Eligibility, Full Details]

- Step 4:- Obtaining the Guarantee Cover

After the loan is sanctioned, the bank applies to the CGTMSE authority and obtains the guarantee cover. In case the loan is approved by CGTMSE, the borrower has to pay a guarantee fee and service charges. Along with this the loan application form of CGTMSE Scheme can be downloaded from the official website of this scheme. Apart from this, a total of 141 banks including all the major rural, urban, public sector and private sector banks of the country have been included in the expanded list of MLIs under this scheme launched by the Central Government. Some of the big banks included in this list are State Bank of India, United Bank of India, Punjab National Bank etc. [Also read- PM Kisan Beneficiary List | pmkisan.gov.in 12th Installment List]

Note:- CGTMSE does not provide any kind of loan, credit facility, or subsidy, nor does it have any loan agents, agencies for arranging loans, or credit guarantees offered through its MLIs .

Claim Settlement Procedure

There is a lock-in period of 18 months for preferred claims after the last part of the loan amount is disbursed. After the default account is notified as NPA, the lender gives priority to a claim and the process of recovery after the account is declared as NPA is known as CGTMSE claim settlement process. [Also read- PM KISAN Registration: pmkisan.gov.in Registration, Beneficiary Status Check]

Credit Guarantee Scheme (CGTMSE) Achievements (FY 2021-2022)

Proposals Approved:- 7,09,883

| Financial Year | Total Number of Cases | Credit Guarantee Extended Amount(Rs. in Crore) | Total Number of Claims Settled | Total Number of Claims Settled Amount(Rs. in Crore) |

| 2021-22 | 709883 | 55217.74 | 32963 | 742.74 |

Financial Year’s Data – 2021-22

| Guarantees Approved during FY 2022 | Rs. 56,172 Crore |

| No of Guarantees Approved during FY 2022 | 7, 17, 020 |

| Growth in coverage in terms of the amount | 52% |

| Growth in new products – Retail & Hybrid | Rs. 35,033 crore |

Category Wise Credit Guarantee

| Category | Maximum extent of Guarantee where credit facility is |

| Upto 5 lakh | Above 5 Lakh upto 50 Lakh | Above 50 Lakh upto 2 Crore | |

| Micro Enterprises | 85% of the amount in default subject to a maximum of 4.25 lakh | 75% of the amount in default subject to a maximum of 37.50 lakh | 75% of the amount in default subject to a maximum of 150 lakh |

| Women entrepreneurs/ Units located in the NorthEast Region (incl. Sikkim) (other than credit facility upto 5 lakh to micro enterprises) | 80% of the amount in default subject to a maximum of 40 lakh | 80% of the amount in default subject to a maximum of 40 lakh | 75% of the amount in default subject to a maximum of 150 lakh |

| All other category of borrowers | 75% of the amount in default subject to a maximum of 37.50 lakh | The 75% of the amount in default subject to a maximum of 37.50 lakh | 75% of the amount in default subject to a maximum of 150 lakh |

| Activity | From10 lakh upto100 lakh | ||

| MSE Retail Trade | 50% of the amount in default subject to a maximum of 50 lakh |

Features of Credit Guarantee Scheme

| Interest Rates | As per RBI’s Guidelines is eligible for coverage under CGTMSE Scheme |

| Eligible Activities | Manufacturing and Services including Retail trade is allowedEducational and Training institutions, Self Help Groups (SHGs), and agriculture-related activities are not eligible |

| Loan Amount | For Micro and Small Enterprises (MSEs)– Credit facility up to Rs. 200 lakh can be covered on an outstanding basisFor Regional Rural Banks (RRBs) and Select Financial Institutions credit facility up to Rs. 50 lakh is allowed |

| Guarantee Coverage | From 75% – 85% (50% Coverage for retail activity) |

| Collateral / Third Party Guarantee | Not required |

Comparison of Business Loan Interest Rates offered by Top Banks/NBFCs – September 2024

| Bank/NBFCs | Interest Rate |

| HDFC Bank | 10.00% – 22.50% p.a. |

| FlexiLoans | 1% per month onwards |

| ZipLoan | 1% – 1.5% per month (Flat ROI) |

| Axis Bank | 14.25% – 18.50% p.a. |

| IDFC First Bank | 14.50% Onwards |

| Kotak Mahindra Bank | 16% – 19.99% |

| Fullerton Finance | 17% – 21% |

| Bajaj Finserv | 17% p.a. onwards |

| RBL Bank | 17.50% – 25% p.a. |

| ICICI Bank | 17% onwards |

| Indifi Finance | 1.5% per month onwards |

| Lendingkart Finance | 1.5% – 2% per month |

| Tata Capital Finance | 19% p.a. onwards |

| NeoGrowth Finance | 19% – 24% p.a. |

| Hero FinCorp | Up to 26% p.a. |

Note:- Business loan interest rates are updated as of September 2024.

Lending Institutions offering funds under CGTMSE Scheme

- Scheduled Commercial Banks (SCBs)

- Regional Rural Banks (RRBs)

- Small Finance Banks (SFBs)

- Non-banking Financial Companies (NBFCs)

- Small Industrial Development Bank of India (SIDBI)

- National Small Industries Corporation (NSIC)

- North Eastern Development Finance Corporation Ltd. (NEDFi)

The limit of guarantee cover for micro and small enterprises operated or owned by women is 80%, while for credit facilities in the NorthEast Region (NER) all credits or loans are eligible for a guarantee of Rs 50 lakh.

Note:- Educational institutions, agriculture, training institutes and Self Help Groups (SHGs) are not considered eligible for the guarantee cover under the Credit Guarantee Scheme. Along with this, the loan limit under this scheme completely depends on the profile and business requirements of the applicant.

Modified AGF Structure – Standard rate (SR)

| Annual Guarantee Fee (AGF) [% p.a.]* |

| Credit Facility | Women, Micro Enterprises and Units covered in North East Region | Others |

| Up to Rs. 5 Lakh | 1.00 + Risk Premium as per extant guidelines of the Trust | 1.00 + Risk Premium as per extant guidelines of the Trust |

| Above Rs. 5 Lakh and up to Rs. 50 Lakh | 1.35 + Risk Premium as per extant guidelines of the Trust | 1.50 + Risk Premium as per extant guidelines of the Trust |

| Above Rs. 50 Lakh and up to Rs. 2 Crore | 1.80 + Risk Premium as per extant guidelines of the Trust | 1.80 + Risk Premium as per extant guidelines of the Trust |

Note:- AGF will be levied on the guaranteed amount for the first year and on the outstanding balance for the remaining period of the credit facility.

Benefits and Features of Credit Guarantee Scheme (CGTMSE)

- This scheme was launched by the Ministry of Micro, Small and Medium Enterprises, Government of India to strengthen the credit delivery system and to facilitate the flow of credit to the MSE sector.

- Through this scheme bank loans will be made available to the beneficiaries without collateral or third party guarantee.

- Under this scheme, loans will be provided to the first generation entrepreneurs of the country, so that they can set up a unit of their own micro and small enterprises.

- Both the Central Government and SIDBI have jointly set up a Credit Guarantee Fund Trust for Micro and Small Enterprises.

- If the beneficiary entrepreneur is unable to pay his loan, then with the help of this scheme, up to a certain amount of loss will be paid to the lender by the central government.

- The balance part of the loan facility is covered under this scheme up to a maximum of 200 lakhs.

Beneficiaries of Credit Guarantee Scheme

- Manufacturing business

- Services related business

- Retail trade

Ineligibility of Credit Guarantee Scheme

- Educational/Training Institute

- Self help group

- Agriculture

Operational Overview of CGTMSE Scheme

| Guarantee approved during financial year | ₹45,851 Crore |

| Growth and coverage in terms of amount | 52% |

| Significant growth of new products-retail and hybrid | ₹16103 crore |

| Guarantees improved during financial year for 23 new registered NBFC | ₹17,349 crore |

Extent of Guarantee Cover of Credit Guarantee Scheme

- Up to Rs 5 lakh micro-enterprises:- 85%

- Up to 50 lakh women entrepreneurs/units located in North eastern region including Sikkim:- 80%

- From 5 lakh to 200 lakh for other categories:- 75%

- Up to Rs 100 lakh MSE retail trade:- 50%

Steps In Getting Coverage

- Applicant registration

- GST details

- ITR upload

- Data fill up

- Select bank for processing

- Provisional guarantee certificate

Member Lending Institute Under Credit Guarantee Scheme (CGTMSE)

- 12 public sector bank

- 22 private sector banks

- 51 RRB

- 5 foreign banks

- 9 Financial institutions

- 28 NBFC

- 6 SFB

- 8 SUCB

Eligibility Criteria of CGTMSE Scheme

Entrepreneurs wishing to apply under the Credit Guarantee Scheme launched by the Government of India will have to fulfill the following eligibility criteria: –

- The applicant must be a permanent resident of India.

- Applicant must be a first generation entrepreneur

Required Documents

- Aadhar Card

- Ration card

- Income certificate

- Passport size photograph

- GST details

- Income tax return

- Bank account details

- Mobile number

- Email ID etc

Online Registration under Credit Guarantee Scheme (CGTMSE)

If you are willing to register under the CGTMSE Scheme started by the Central Government, then you have to follow the following guidelines:-

- First of all you have to go to the official website of the Credit Guarantee Scheme. Now the home page of the website will open in front of you.

- On the homepage of the website, you have to click on the register option. After that you will be redirected to a new page.

- On this new page you have to click on the register option once again. Now you have to enter all the required information asked like:- Name, Email ID, Mobile Number and Captcha Code details.

- After entering all the information, you have to click on the option of Get OTP. Now you have to enter the OTP received on your mobile in the OTP box.

- After that you have to click on the Register option. Now you have to login after entering the details of your login credentials.

- Now you have to enter your GST details. After this you have to upload your Income Tax Return.

- After that you will have to enter the required details of the asked information and update your bank account information.

- Now you have to click on the submit option, after which you can apply.

Member Login Procedure

- First of all you have to go to the official website of the Credit Guarantee Scheme. After this the homepage of the website will open in front of you.

- On the homepage of the website, you have to click on the option “Member Login”. Now some options will be displayed in front of you.

- Now you have to click on the option as per your requirement. After that the next page will open in front of you.

- On this page you have to enter your login credentials. Now you have to click on the login option.

- In this way you can login as a member.

Download Financial Reports

- First of all you have to visit the official website of the Credit Guarantee Scheme. After this the homepage of the website will open in front of you.

- On the homepage of the website, you have to click on the option “Financial Information Option ” and click on Financial Report. After that the next page will open in front of you.

- On this page you will see some options. You have to click on the option as per your requirement.

- This is how you can download financial reports.

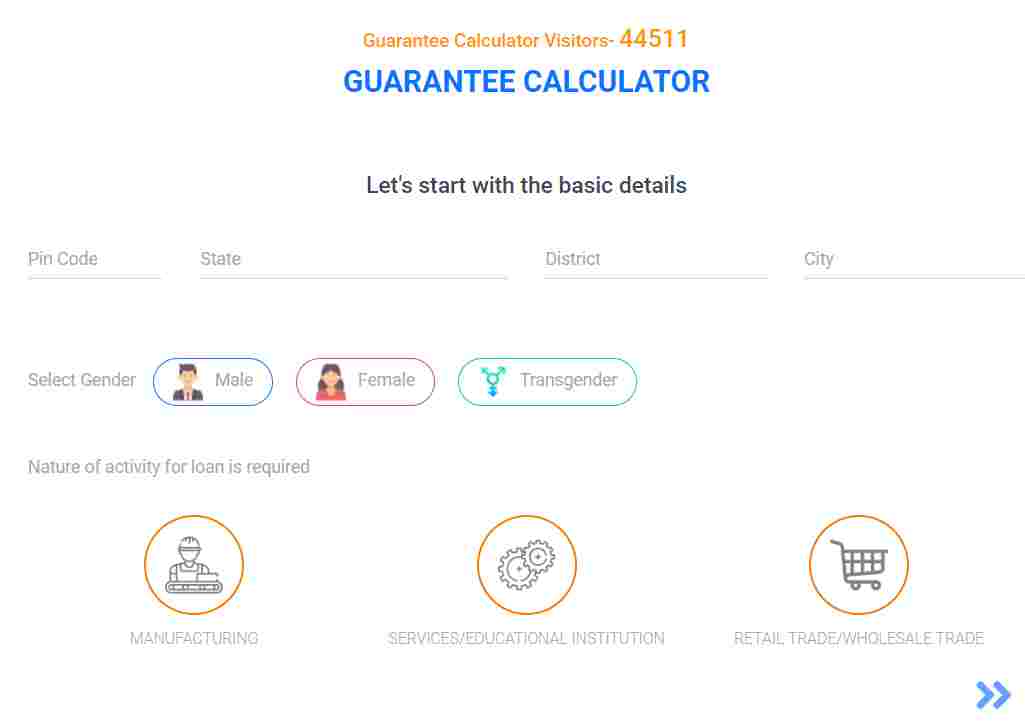

Procedure To Calculate Guarantee

- First of all you have to visit the official website of the Credit Guarantee Scheme. After this the homepage of the website will open in front of you.

- On the homepage of the website, you have to click on the option of “Guarantee Calculator“. After that the next page will open in front of you.

- On this page, you have to enter the details of all the information asked like – Pin Code, State, District, Gender, Nature of Activity etc.

- Now you have to click on the submit option. In this way you can calculate the guarantee.

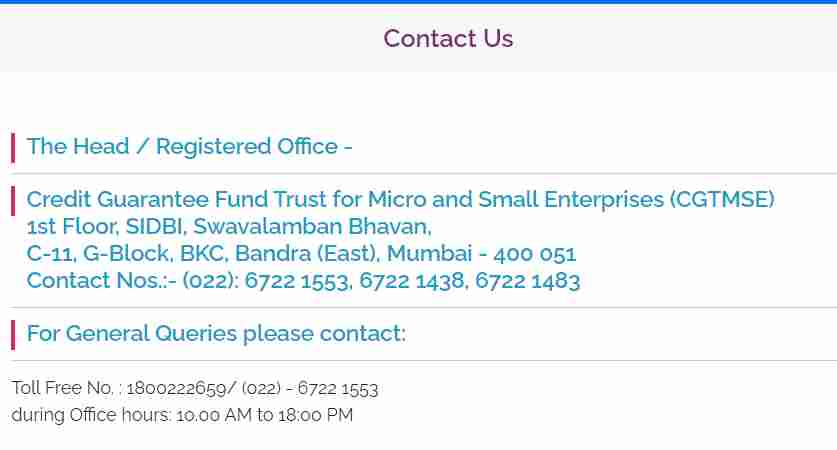

Procedure to View Contact Details

- First of all you have to go to the official website of the Credit Guarantee Scheme. Now the home page of the website will be displayed on your screen.

- On the homepage of the website, you have to click on the option of “Contact Us“. After this a new page will open in front of you.

- Now you will be able to see all the necessary information related to the contact details of Credit Guarantee Scheme (CGTMSE) on this new page.

Contact Details

- Toll-Free Number:- 1800-222-659 / (022)-6722-1553