IGR Odisha Registration, Stamp Duty & Land Valuation Status | Check IGR Odisha Application Status & Stamp Duty @ igrodisha.gov.in – The igrodisha.gov.in portal has been launched by the Odisha government for the citizens of its state, through which it has become easier to register your property in Odisha. Apart from this, through this the organization is encouraged to take collective decisions to facilitate smooth communication among the citizens. This registration is done through the Inspector General Revenue and Disaster Management Department on the IGR Odisha Portal. [Also read- Mukhyamantri Karma Tatpara Abhiyan: Mukta Yojana Online Registration]

igrodisha.gov.in Portal

IGR Odisha has been launched in the state by the Inspector General of Registration (IGR) to facilitate all the residents of the state to register their property. Through this portal, citizens get help in registration of property documents, along with this, money is also earned continuously through stamp duty. In addition, the state government has launched igrodisha.gov.in Portal with the aim of leveraging digital technologies to provide services to the users in a timely and transparent manner. Additionally, a user-friendly registration service is provided through this portal, thereby assisting the State Government in maintaining and protecting the interests of the Government of Odisha and its citizens. [Also read- (BSKY) Odisha Biju Swasthya Kalyan Yojana: Apply Online, Eligibility]

Overview of IGR Odisha Portal

| Scheme Name | IGR Odisha Portal |

| Launched By | Inspector General of Registration (IGR), Odisha |

| Year | 2024 |

| Beneficiaries | Citizens of Odisha State |

| Application Procedure | online |

| Objective | Registering properties of residents of the state |

| Benefits | The properties of the residents of the state will be registered |

| Category | Odisha Government Schemes |

| Official Website | https://www.igrodisha.gov.in/ |

Objectives of IGR Odisha Portal

The main objective of IGR Odisha Portal is to make it easy to register the property of all the residents of the state. Apart from this, some tasks like public authority management etc. are completed through this. Along with this, one of the goals of this portal is to issue guidelines for fulfilling the conditions of Indian Stamp Act or Indian Registration Act. Under this, it is done to protect the interests of the government as well as to facilitate better services for the wider population. Through the igrodisha.gov.in portal, everything required for the registration offices of Odisha can be created. [Also read- Kalia Yojana Application Form: Apply Online Form, kalia.co.in Status]

Required Documents of IGR Odisha Portal

- All records showing who is the real owner of the property.

- Proof of Identity like Aadhaar Card, Driving License, PAN Card, Passport or EPIC etc.

- Passport size photograph of each claimant and user.

- They have to file Form No. 60 under the Income Tax Act, if they are unable to produce the copy of their PAN card.

- The executors and claimants have to provide a photocopy of the PAN card in case the value of the document exceeds ten lakh rupees.

- If the applicant is the holder of the power of attorney document, both the joint power of attorney registration along with the photo identity verification document of the attorney must be registered.

- Published encumbrance certificate as well as ROR has to be submitted.

- A prescribed format declaration duly signed by the transferor and the transferee is required if the property being transferred does not consist of any building or structure.

- A legally binding declaration must be signed by both the transferor and the transferee, if any resident has any building or other structure on the land.

- Necessary permission from the revenue officer is required in case a person belonging to Scheduled Caste or Scheduled Tribe transfers property to a non-Scheduled Caste or Scheduled Tribe person.

- Additionally, the issue of an NOC or necessary authorization by the competent authority of the endowment should be done for transfer of the deity’s property.

Procedure to Calculate Stamp Duty and Registration Fee on igrodisha.gov.in Portal

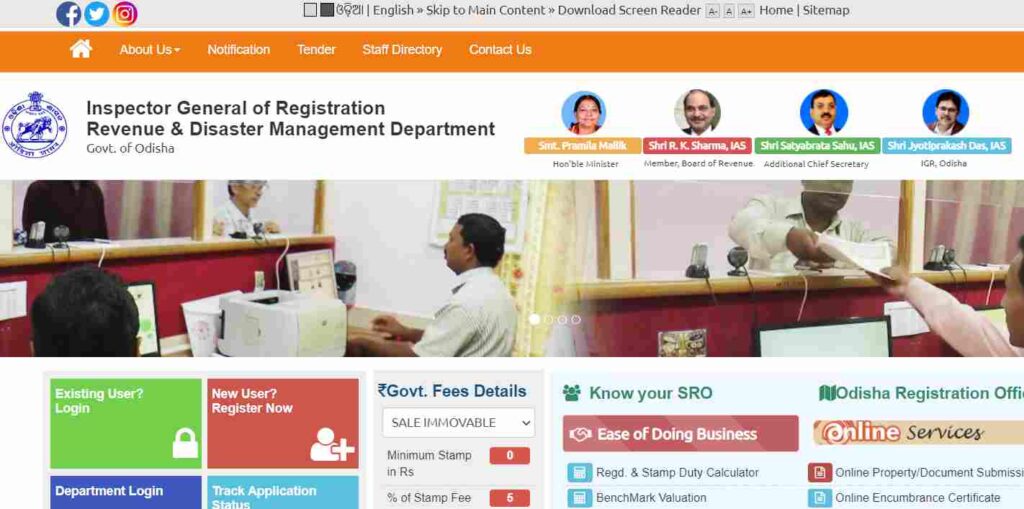

- First of all you have to visit the official website of IGR Odisha Portal. After this the homepage of the website will open in front of you.

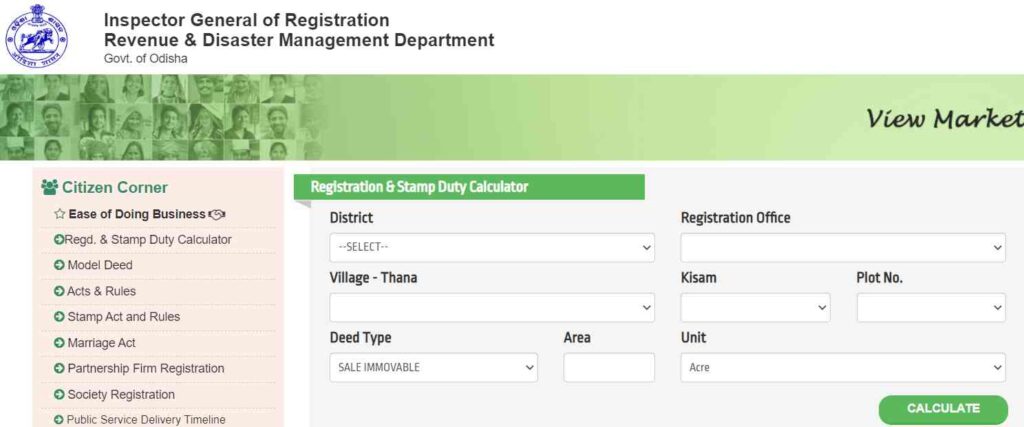

- On the homepage of the website, you have to click on the option of Regd & Stamp Duty Calculator from the section of Ease of Doing Business. After this the next page will open in front of you.

- Here you have to enter the details of all the information asked like- district, registration office, village-station, farmer, plot number, area, deed type, unit etc.

- Then you have to click on the option to calculate stamp duty and registration fee, by following this process you can calculate stamp duty and registration fee.