National Saving Certificate Tax Calculator, NSC Interest Rate & Benefits | National Savings Certificate Online Eligibility & Features – A fixed income scheme has been started by the Central Government, named National Saving Certificate; it can be opened through the post office. This scheme is being actively promoted by the Government of India, in this direction this scheme is introduced in all the post offices of the country. The campaign has gained a lot of traction in India because of the large number of post offices in the country and the convenient access to them. The NSC Scheme has been started to provide benefits to all the citizens of the country. (Also read- (रजिस्ट्रेशन) बाल आधार कार्ड: ऑनलाइन आवेदन, ब्लू आधार कार्ड एप्लीकेशन फॉर्म)

National Saving Certificate

The National Savings Certificate is designed to support modest or medium-sized savings, the scheme is a taxable investment. The benefit of this scheme can be obtained through any post office in the country; this scheme has been started by the Central Government. Additionally, the scheme has a very low risk appetite as it is backed by the central government, and the program will not be applicable to Non-Resident Indians (NRIs) or HUFs, who are mainly Indian citizens. The NSC Scheme is becoming very famous due to low minimum investment requirements, National Pension System, income tax benefits and minimum risk. The benefit of this scheme will be mainly provided to all the citizens of the state. (Also read- (Registration) Sail Pension Scheme: Download Application Form PDF)

Overview of National Saving Certificate

| Scheme Name | NSC Scheme |

| Launched By | Central Government Schemes |

| Year | 2024 |

| Beneficiaries | All citizens of the country |

| Application Procedure | Online |

| Objective | To encourage the citizens of the country to save more than a modest amount of money. |

| Benefits | The citizens of the country will be encouraged to save more than a modest amount of money. |

| Category | Central Government Schemes |

| Official Website | ——— |

Objectives of National Savings Certificate

The main objective of the National Savings Certificate (NSC) is to encourage the citizens of the country to save a moderate amount of money. Through this, tax benefits are provided to the citizens of the country, under this scheme, all the citizens of the country can easily invest and due to the support of the Government of India, it is very safe to invest under the National Saving Certificate. Along with this, the citizen will also be able to save more through a small investment. (Also read- UIDAI e Learning Portal: Online Registration, e-learning.uidai.gov.in Login)

Benefits of National Savings Certificate (NSC)

- All citizens of the country get tax savings by investing under the National Savings Certificate (NSC).

- Along with this, returns are also ensured through this scheme, this program is very popular, because through this program a stable income will be provided to all the retired citizens.

- A duplicate certificate can be ordered in case the original is lost, in addition to the interest earned in the last year, the balance interest that arises is tax-free.

- Under the National Savings Certificate, individuals have the option to continue investing even after the maturity period.

- This certificate can be transferred from one person to another, thereafter it is also allowed only once during the lock-in time.

Features of National Savings Certificate

- Under this scheme a certificate can be obtained as low as Rs 100, apart from this the certificate is also available at Rs 10,000, 5,000, 1,000, 500.

- Under this, investment can be made under this scheme by making small investments by all the citizens of the country, when they become practical, then the investment under it is increased.

- One can choose between two maturity periods 5 years and 10 years, now the interest rate has been increased by the government from 6.8% to 7%.

- It has been compounded annually, under which interest is payable only on maturity. More nominations can be added by the investing family members and minors.

- If the investor dies within the National Savings Certificate (NSC), the nominee is eligible to inherit the scheme.

- NSC can be used as security or collateral while applying for a loan from the bank. However, permission from the postmaster concerned is required for transfer of the certificate to the bank.

- After providing the necessary documents under the NSC Scheme from the post offices can be obtained.

- Apart from this, the two types of certificates introduced in the beginning of this scheme were NSC IX Marks and NSC VIII Marks. By the way, the NSC IX issue was abandoned by the Government of India till December 2015, that’s why only NSC VIII issue exists.

National Savings Certificate Interest Rate 2024

The interest rate on National Savings Certificates is subject to change depending on the decisions announced by the Ministry of Finance from time to time. The relevant NSC interest rate for the fourth quarter of FY 2022-23 (January-March) is 7.0% per annum. In the previous quarter, the NSC rate was 6.8%. Every year, interest is compounded through this scheme, the following are the historical interest rates of this scheme:-

| Duration | Rate of interest |

| Q3 FY 2022-23 | 6.8% |

| Q2 FY 2022-23 | 6.8% |

| Q1 FY 2022-23 | 6.8% |

| Q4 FY 2021-22 | 6.8% |

| Q3 FY 2021-22 | 6.8% |

| Q2 FY 2021-22 | 6.8% |

| Q1 FY 2021-22 | 6.8% |

| Q4 FY 2020-21 | 6.8% |

| Q4 FY 2019-20 | 7.9% |

| Q1 FY 2018-19 | 7.6% |

| Q2 FY 2018-19 | 7.6% |

| Q3 FY 2018-19 | 8.0% |

| Q4 FY 2018-19 | 8.0% |

| Q1 FY 2019-20 | 8.0% |

| Q2 FY 2019-20 | 7.9% |

| Q3 FY 2019-20 | 7.9% |

How to Invest in NSC through Electronic Mode?

All the citizens of the country who have a bank or post office savings account can invest electronically in the National Savings Certificate. Citizens willing to invest under this need an internet banking facility for savings bank accounts. Further, if the account is not maintained by the person, it should be reactivated by him/her and apply for an internet banking facility. Can be easily placed under NSC Scheme in electronic mode similar to e-FD or e-Recurring Deposit. (Also read- E Sanjeevani OPD: Patient Registration, esanjeevaniopd.in Mobile App)

Comparing NSC with Other Tax-Saving Investments

NSC is one of the tax-saving investment options available. This information is received under section 80C of the Income Tax Act, 1961. Apart from this, other popular options are Equity Linked Savings Schemes (ELSS), National Pension System (NPS), Public Provident Fund (PPF), Savings Fixed Deposit (FD) and Tax etc. Here is how NSC is compared with other tax-saving investments:-

| Investment | Interest | Lock-in period | Risk profile |

| NSC | 7% p.a. | 5 years | low risk |

| ELSS Fund | Market-linked, showing historical returns of 12% to 15% per year | 3 years | market risk |

| PPF | 7.1% per annum | 15 years | low risk |

| NPS | Market-linked, showing historical returns of 8% to 10% per year | until retirement | market risk |

| FD | 4% to 7% per annum | 5 years | low risk |

Citizens of the country who are looking for capital protection and tax deduction under section 80C can invest in the National Savings Certificate (NSC).

Holding National Savings Certificate in Various Ways

Such citizens of the country who want to invest under the National Saving Certificate, can invest in the following ways:-

- Joint type of certificate – In this case the certificate is held by citizens with two investors, each of whom will receive an equal share of the maturity proceeds.

- Single Holder Type Certificate – Single Holder Certificate can be purchased by an investor for himself or on behalf of a minor.

- Joint B Type Certificate – Only one holder will get the maturity amount under this certificate as this certificate is a joint holding.

Eligibility for National Savings Certificate

- It is mandatory for a citizen who wants to get the benefit of this scheme to be a native citizen of India.

- There is no minimum or maximum age requirement to get the benefit of this certificate.

- Such citizens of India who do not live in India cannot invest in NSC.

- NSC can be bought by any person on behalf of a minor or invested along with any other adult.

- The benefit of this scheme cannot be obtained by HUF and Trust NSC 8th Issue.

Required Documents

- passport size photo

- nsc application form filled

- identity proof

- Aadhar card

- PAN card

- Aadhar card

- Voter ID

- Cash/cheque deposit of the amount to be invested

Procedure to Invest Offline under National Saving Certificate

National Saving Certificate is provided on receipt of required KYC documents by any Indian Post Office in the country, the process of investing under this scheme is as follows:-

- First of all you have to go to the Indian Post Office and get the NSC Application Form, after that you have to fill the NSC Application Form.

- Now you have to submit the self-attested copies of the required KYC documents, after that you will also have to bring the original documents to the post office for additional verification.

- After this you have to pay the investment amount by cash or cheque. NSCs of the appropriate amount will be printed after the purchase process of the certificates is complete, and can be collected from the post office.

- By following this process you can invest under the National Savings Certificate (NSC).

Procedure to Invest Online under NSC Scheme

All the citizens of the country who want to invest online under National Savings Certificate (NSC), can invest online under this scheme by following the following procedure:-

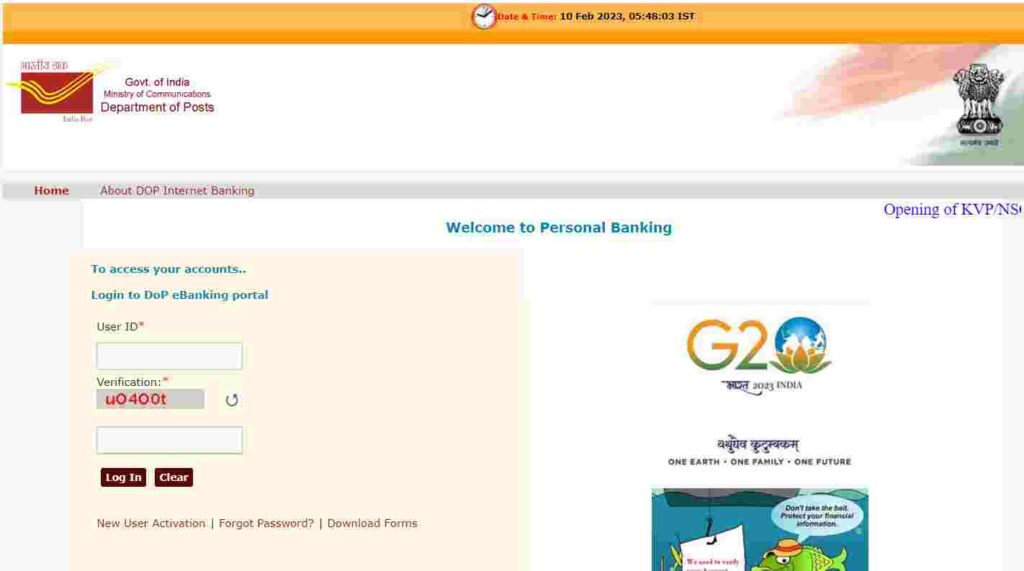

- First of all you have to go to the official website of DOP Internet Banking, after that the homepage of the website will open in front of you.

- On the homepage of the website, you have to enter the login information, after that you have to click on the option of login.

- Now under the General Services section, you have to click on the option of Service Request, then click on the option of New Request.

- Then a new page will open in front of you, now you have to select the NSC account, after that you have to enter the minimum deposit amount for NSC.

- After this you have to select your Debit Account linked to PO Savings Account, after that, accept the terms and conditions and click on the submit option to submit the application.

- Now you have to enter the transaction password. To download the receipt, one has to click on the option of View/Download Deposit Receipt.

- By following this process, you can invest online under the National Saving Certificate.

National Savings Certificate Maturity Period and Premature Withdrawal

Such citizens of the country by whom money is invested under the National Saving Certificate, then the money invested by them cannot be withdrawn before the maturity period of 5 years. Under this, premature withdrawal is allowed in many situations, under this the following are examples of allowing premature withdrawal:-

- Under this, if the certificate holder dies, the investor is allowed to withdraw.

- In case the certificate is lost, the pledgee must be a government official with a gazette certificate.

- Invested cash can only be withdrawn under a court order.